Page 39 - Insurance Times April 2017 Special Issue on Newindia

P. 39

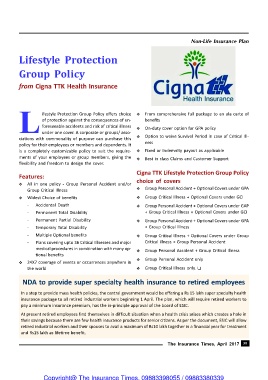

Non-Life Insurance Plan

Lifestyle Protection

Group Policy

from Cigna TTK Health Insurance

L ifestyle Protection Group Policy offers choice From comprehensive full package to an ala carte of

benefits

of protection against the consequences of un-

foreseeable accidents and risk of critical illness

On-duty cover option for GPA policy

under one cover. A corporate or groups/ asso-

Option to waive Survival Period in case of Critical Ill-

ciations with commonality of purpose can purchase this

ness

policy for their employees or members and dependents. It

is a completely customizable policy to suit the require- Fixed or Indemnity payout as applicable

ments of your employees or group members, giving the

Best in class Claims and Customer Support

flexibility and freedom to design the cover.

Cigna TTK Lifestyle Protection Group Policy

Features:

choice of covers

All in one policy - Group Personal Accident and/or

Group Critical Illness Group Personal Accident + Optional Covers under GPA

Widest Choice of benefits Group Critical Illness + Optional Covers under GCI

- Accidental Death Group Personal Accident + Optional Covers under GAP

- Permanent Total Disability + Group Critical Illness + Optional Covers under GCI

- Permanent Partial Disability Group Personal Accident + Optional Covers under GPA

- Temporary Total Disability + Group Critical Illness

- Multiple Optional benefits Group Critical Illness + Optional Covers under Group

- Plans covering upto 36 Critical Illnesses and major Critical illness + Group Personal Accident

medical procedures in combination with many op-

Group Personal Accident + Group Critical Illness

tional benefits

Group Personal Accident only

24X7 coverage of events or occurrences anywhere in

the world Group Critical Illness only.

NDA to provide super specialty health insurance to retired employees

In a step to provide mass health policies, the central government would be offering a Rs 15 lakh super specialty health

insurance package to all retired industrial workers beginning 1 April. The plan, which will require retired workers to

pay a minimum insurance premium, has the in-principle approval of the board of ESIC.

At present retired employees find themselves in difficult situation when a health crisis arises which creates a hole in

their savings because there are few health insurance products for senior citizens. As per the document, ESIC will allow

retired industrial workers and their spouses to avail a maximum of Rs10 lakh together in a financial year for treatment

and Rs15 lakh as lifetime benefit.

The Insurance Times, April 2017 39

Copyright@ The Insurance Times. 09883398055 / 09883380339