Page 157 - IC26 LIFE INSURANCE FINANCE

P. 157

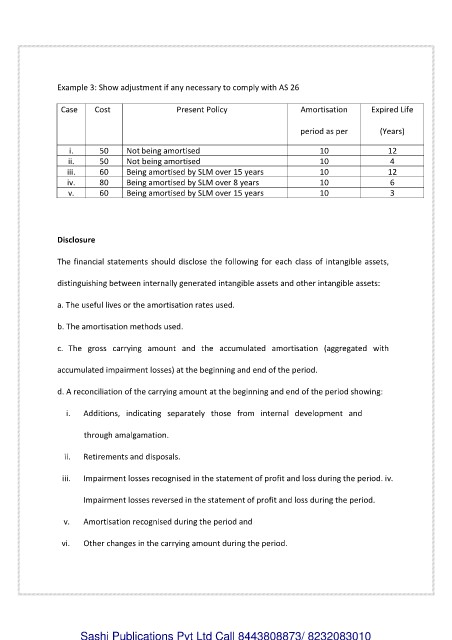

Example 3: Show adjustment if any necessary to comply with AS 26

Case Cost Present Policy Amortisation Expired Life

period as per (Years)

i. 50 Not being amortised 10 12

ii. 50 Not being amortised 10 4

iii. 60 Being amortised by SLM over 15 years 10 12

iv. 80 Being amortised by SLM over 8 years 10 6

v. 60 Being amortised by SLM over 15 years 10 3

Disclosure

The financial statements should disclose the following for each class of intangible assets,

distinguishing between internally generated intangible assets and other intangible assets:

a. The useful lives or the amortisation rates used.

b. The amortisation methods used.

c. The gross carrying amount and the accumulated amortisation (aggregated with

accumulated impairment losses) at the beginning and end of the period.

d. A reconciliation of the carrying amount at the beginning and end of the period showing:

i. Additions, indicating separately those from internal development and

through amalgamation.

ii. Retirements and disposals.

iii. Impairment losses recognised in the statement of profit and loss during the period. iv.

Impairment losses reversed in the statement of profit and loss during the period.

v. Amortisation recognised during the period and

vi. Other changes in the carrying amount during the period.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010