Page 36 - IC26 LIFE INSURANCE FINANCE

P. 36

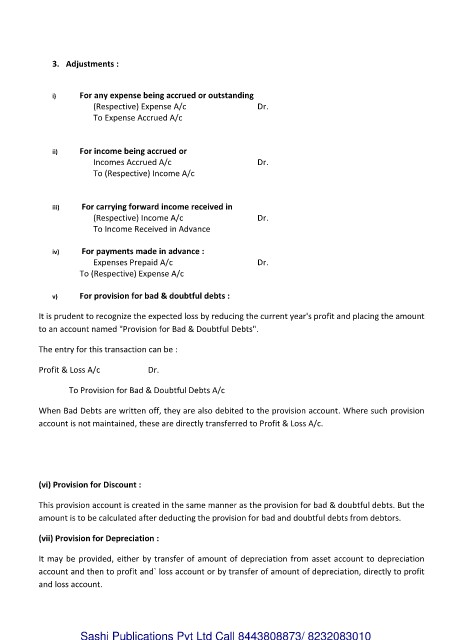

3. Adjustments :

i) For any expense being accrued or outstanding

(Respective) Expense A/c Dr.

To Expense Accrued A/c

ii) For income being accrued or

Incomes Accrued A/c Dr.

To (Respective) Income A/c

iii) For carrying forward income received in

(Respective) Income A/c Dr.

To Income Received in Advance

iv) For payments made in advance :

Expenses Prepaid A/c Dr.

To (Respective) Expense A/c

v) For provision for bad & doubtful debts :

It is prudent to recognize the expected loss by reducing the current year's profit and placing the amount

to an account named "Provision for Bad & Doubtful Debts".

The entry for this transaction can be :

Profit & Loss A/c Dr.

To Provision for Bad & Doubtful Debts A/c

When Bad Debts are written off, they are also debited to the provision account. Where such provision

account is not maintained, these are directly transferred to Profit & Loss A/c.

(vi) Provision for Discount :

This provision account is created in the same manner as the provision for bad & doubtful debts. But the

amount is to be calculated after deducting the provision for bad and doubtful debts from debtors.

(vii) Provision for Depreciation :

It may be provided, either by transfer of amount of depreciation from asset account to depreciation

account and then to profit and` loss account or by transfer of amount of depreciation, directly to profit

and loss account.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010