Page 41 - Banking Finance January 2020

P. 41

ARTICLE

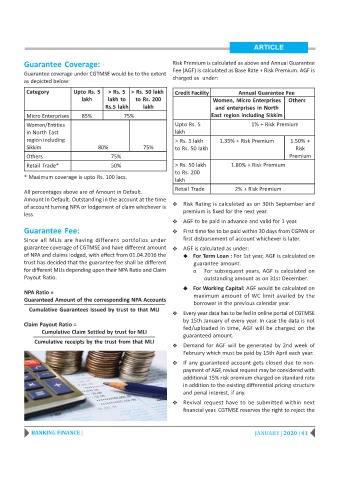

Guarantee Coverage: Risk Premium is calculated as above and Annual Guarantee

Fee (AGF) is calculated as Base Rate + Risk Premium. AGF is

Guarantee coverage under CGTMSE would be to the extent

as depicted below: charged as under:

Category Upto Rs. 5 > Rs. 5 > Rs. 50 lakh Credit Facility Annual Guarantee Fee

lakh lakh to to Rs. 200 Women, Micro Enterprises Others

Rs.5 lakh lakh and enterprises in North

Micro Enterprises 85% 75% East region including Sikkim

Women/Entities Upto Rs. 5 1% + Risk Premium

in North East lakh

region including > Rs. 5 lakh 1.35% + Risk Premium 1.50% +

Sikkim 80% 75% to Rs. 50 lakh Risk

Others 75% Premium

Retail Trade* 50% > Rs. 50 lakh 1.80% + Risk Premium

to Rs. 200

* Maximum coverage is upto Rs. 100 lacs.

lakh

Retail Trade 2% + Risk Premium

All percentages above are of Amount in Default.

Amount In Default: Outstanding in the account at the time

of account turning NPA or lodgement of claim whichever is Y Risk Rating is calculated as on 30th September and

less. premium is fixed for the next year.

Y AGF to be paid in advance and valid for 1 year.

Guarantee Fee: Y First time fee to be paid within 30 days from CGPAN or

Since all MLIs are having different portfolios under first disbursement of account whichever is later.

guarantee coverage of CGTMSE and have different amount Y AGF is calculated as under:

of NPA and claims lodged, with effect from 01.04.2016 the X For Term Loan : For 1st year, AGF is calculated on

trust has decided that the guarantee fee shall be different guarantee amount.

for different MLIs depending upon their NPA Ratio and Claim o For subsequent years, AGF is calculated on

Payout Ratio. outstanding amount as on 31st December.

X For Working Capital: AGF would be calculated on

NPA Ratio = maximum amount of WC limit availed by the

Guaranteed Amount of the corresponding NPA Accounts

borrower in the previous calendar year.

Cumulative Guarantees issued by trust to that MLI

Y Every year data has to be fed in online portal of CGTMSE

by 15th January of every year. In case the data is not

Claim Payout Ratio =

fed/uploaded in time, AGF will be charged on the

Cumulative Claim Settled by trust for MLI

guaranteed amount.

Cumulative receipts by the trust from that MLI

Y Demand for AGF will be generated by 2nd week of

February which must be paid by 15th April each year.

Y If any guaranteed account gets closed due to non-

payment of AGF, revival request may be considered with

additional 15% risk premium charged on standard rate

in addition to the existing differential pricing structure

and penal interest, if any.

Y Revival request have to be submitted within next

financial year. CGTMSE reserves the right to reject the

BANKING FINANCE | JANUARY | 2020 | 41