Page 160 - Fire Insurance Ebook IC 57

P. 160

Fire and Consequential Loss Insurance

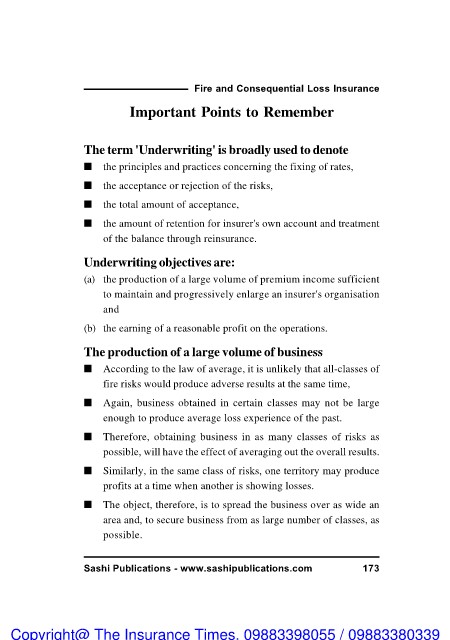

Important Points to Remember

The term 'Underwriting' is broadly used to denote

n the principles and practices concerning the fixing of rates,

n the acceptance or rejection of the risks,

n the total amount of acceptance,

n the amount of retention for insurer's own account and treatment

of the balance through reinsurance.

Underwriting objectives are:

(a) the production of a large volume of premium income sufficient

to maintain and progressively enlarge an insurer's organisation

and

(b) the earning of a reasonable profit on the operations.

The production of a large volume of business

n According to the law of average, it is unlikely that all-classes of

fire risks would produce adverse results at the same time,

n Again, business obtained in certain classes may not be large

enough to produce average loss experience of the past.

n Therefore, obtaining business in as many classes of risks as

possible, will have the effect of averaging out the overall results.

n Similarly, in the same class of risks, one territory may produce

profits at a time when another is showing losses.

n The object, therefore, is to spread the business over as wide an

area and, to secure business from as large number of classes, as

possible.

Sashi Publications - www.sashipublications.com 173

Copyright@ The Insurance Times. 09883398055 / 09883380339