Page 56 - Fire Insurance Ebook IC 57

P. 56

Fire and Consequential Loss Insurance

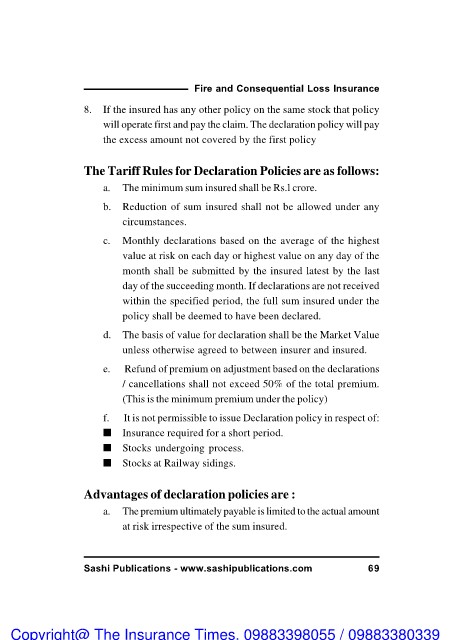

8. If the insured has any other policy on the same stock that policy

will operate first and pay the claim. The declaration policy will pay

the excess amount not covered by the first policy

The Tariff Rules for Declaration Policies are as follows:

a. The minimum sum insured shall be Rs.l crore.

b. Reduction of sum insured shall not be allowed under any

circumstances.

c. Monthly declarations based on the average of the highest

value at risk on each day or highest value on any day of the

month shall be submitted by the insured latest by the last

day of the succeeding month. If declarations are not received

within the specified period, the full sum insured under the

policy shall be deemed to have been declared.

d. The basis of value for declaration shall be the Market Value

unless otherwise agreed to between insurer and insured.

e. Refund of premium on adjustment based on the declarations

/ cancellations shall not exceed 50% of the total premium.

(This is the minimum premium under the policy)

f. It is not permissible to issue Declaration policy in respect of:

n Insurance required for a short period.

n Stocks undergoing process.

n Stocks at Railway sidings.

Advantages of declaration policies are :

a. The premium ultimately payable is limited to the actual amount

at risk irrespective of the sum insured.

Sashi Publications - www.sashipublications.com 69

Copyright@ The Insurance Times. 09883398055 / 09883380339