Page 85 - DTPA Journal December 21

P. 85

e Journal

eJournal

Nov. - Dec., 2021

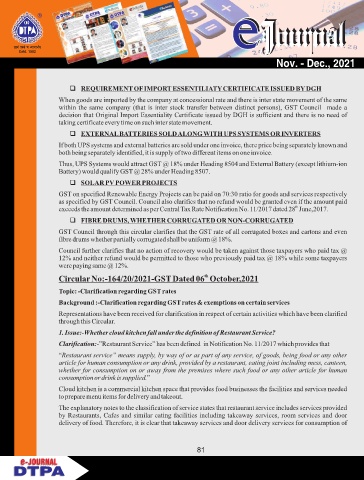

REQUIREMENT OF IMPORT ESSENTILIATY CERTIFICATE ISSUED BY DGH

When goods are imported by the company at concessional rate and there is inter state movement of the same

within the same company (that is inter stock transfer between distinct persons), GST Council made a

decision that Original Import Essentiality Certificate issued by DGH is sufficient and there is no need of

taking certificate every time on such inter state movement.

EXTERNAL BATTERIES SOLD ALONG WITH UPS SYSTEMS OR INVERTERS

If both UPS systems and external batteries are sold under one invoice, there price being separately known and

both being separately identified, it is supply of two different items on one invoice.

Thus, UPS Systems would attract GST @ 18% under Heading 8504 and External Battery (except lithium-ion

Battery) would qualify GST @ 28% under Heading 8507.

SOLAR PV POWER PROJECTS

GST on specified Renewable Energy Projects can be paid on 70:30 ratio for goods and services respectively

as specified by GST Council. Council also clarifies that no refund would be granted even if the amount paid

th

exceeds the amount determined as per Central Tax Rate Notification No. 11/2017 dated 28 June,2017.

FIBRE DRUMS, WHETHER CORRUGATED OR NON-CORRUGATED

GST Council through this circular clarifies that the GST rate of all corrugated boxes and cartons and even

fibre drums whether partially corrugated shall be uniform @ 18%.

Council further clarifies that no action of recovery would be taken against those taxpayers who paid tax @

12% and neither refund would be permitted to those who previously paid tax @ 18% while some taxpayers

were paying same @ 12%.

th

Circular No:-164/20/2021-GST Dated 06 October,2021

Topic: -Clarification regarding GST rates

Background :-Clarification regarding GST rates & exemptions on certain services

Representations have been received for clarification in respect of certain activities which have been clarified

through this Circular.

1. Issue:-Whether cloud kitchen fall under the definition of Restaurant Service?

Clarification:-”Restaurant Service” has been defined in Notification No. 11/2017 which provides that

“Restaurant service‟ means supply, by way of or as part of any service, of goods, being food or any other

article for human consumption or any drink, provided by a restaurant, eating joint including mess, canteen,

whether for consumption on or away from the premises where such food or any other article for human

consumption or drink is supplied.‟

Cloud kitchen is a commercial kitchen space that provides food businesses the facilities and services needed

to prepare menu items for delivery and takeout.

The explanatory notes to the classification of service states that restaurant service includes services provided

by Restaurants, Cafes and similar eating facilities including takeaway services, room services and door

delivery of food. Therefore, it is clear that takeaway services and door delivery services for consumption of

81

e-JOURNAL

e-JOURNAL