Page 32 - Banking Finance December 2019

P. 32

ARTICLE

In July 2010, the Reserve Bank replaced the BPLR system (MCLR) for pricing of loans in the banking system in India

with the base rate system. The actual lending rate was the has not resulted in satisfactory monetary transmission so far.

base rate (for which an indicative formula was also Hence, the Internal Study Group constituted by the Reserve

prescribed) along with the spread. However, the flexibility Bank to review the working of the MCLR system in its report

accorded to banks in the determination of cost of funds - recommended switchover to one of the three external

average, marginal or blended cost - which was a key benchmarks, viz., the treasury bill rate, the CD rate and the

component of base rate calculation - resulted in opacity in Reserve Bank's policy repo rate.

the base rate computed by banks. In particular, the average

cost of funds did not move much with monetary policy Period Change Change in Change in Change

changes due to the term nature of deposits. Moreover, in Policy average weighted in WALR

banks often changed over time the spread over the base rate term average fresh

rate for some borrowers, even without any change in credit Deposit Lending rupee

quality of borrowers, while leaving the base rate unchanged. rate rate o/s loan

Jan 2015 -2.00 -2.11 -1.58 -2.04

Given these deficiencies, the RBI introduced a new lending to Dec

rate system for banks in the form of the marginal cost of 2017

funds based lending rate (MCLR) in April 2016. Unlike the

Jan 2018 0.25 0.31 0.07 0.28

BPLR and the base rate, the formula for computing the

to March

MCLR was prescribed. While some discretion remained with

2019

banks, the MCLR has continued to suffer from the same flaw

in that transmission to the existing borrowers has remained After March 19 Repo rate was reduced twice from 6.25. on

muted as banks adjust, in many cases in an arbitrary manner,

4 April 2019 by 25bps and 6 june 2019 by 25bps and current

the MCLR and/or spread over MCLR, which has kept overall

repo rate is 5.75

lending rates high in spite of the monetary policy being

accommodative since January 2015.

Recommendations of the Internal Study

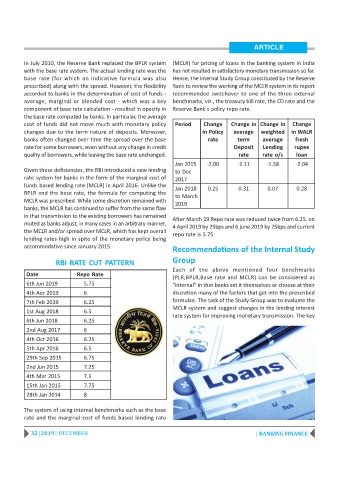

RBI RATE CUT PATTERN Group

Each of the above mentioned four benchmarks

Date Repo Rate

(PLR,BPLR,Base rate and MCLR) can be considered as

6th Jun 2019 5.75 "internal" in that banks set it themselves or choose at their

4th Aur 2019 6 discretion many of the factors that get into the prescribed

7th Feb 2019 6.25 formulae. The task of the Study Group was to evaluate the

MCLR system and suggest changes in the lending interest

1st Aug 2018 6.5

rate system for improving monetary transmission. The key

6th Jun 2018 6.25

2nd Aug 2017 6

4th Oct 2016 6.25

5th Apr 2016 6.5

29th Sep 2015 6.75

2nd Jun 2015 7.25

4th Mar 2015 7.5

15th Jan 2015 7.75

28th Jan 2014 8

The system of using internal benchmarks such as the base

rate and the marginal cost of funds based lending rate

32 | 2019 | DECEMBER | BANKING FINANCE