Page 57 - DTPA Journal Aug 18

P. 57

DTPA - J | 2017-18 | Volume 3 | August 2018

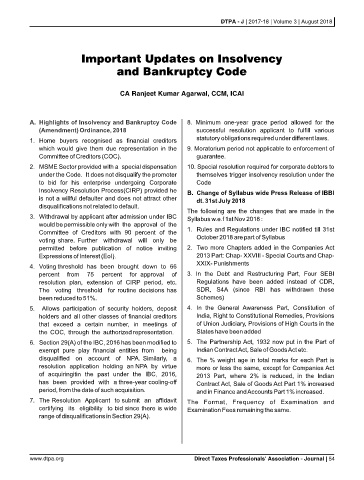

Important Updates on Insolvency

and Bankruptcy Code

CA Ranjeet Kumar Agarwal, CCM, ICAI

A. Highlights of Insolvency and Bankruptcy Code 8. Minimum one-year grace period allowed for the

(Amendment) Ordinance, 2018 successful resolution applicant to fulfill various

1. Home buyers recognised as financial creditors statutory obligations required under different laws.

which would give them due representation in the 9. Moratorium period not applicable to enforcement of

Committee of Creditors (COC). guarantee.

2. MSME Sector provided with a special dispensation 10. Special resolution required for corporate debtors to

under the Code. It does not disqualify the promoter themselves trigger insolvency resolution under the

to bid for his enterprise undergoing Corporate Code

Insolvency Resolution Process(CIRP) provided he B. Change of Syllabus wide Press Release of IBBI

is not a willful defaulter and does not attract other

dt. 31st July 2018

disqualifications not related to default.

The following are the changes that are made in the

3. Withdrawal by applicant after admission under IBC

Syllabus w.e.f 1st Nov 2018 :

would be permissible only with the approval of the

Committee of Creditors with 90 percent of the 1. Rules and Regulations under IBC notified till 31st

voting share. Further withdrawal will only be October 2018 are part of Syllabus

permitted before publication of notice inviting 2. Two more Chapters added in the Companies Act

Expressions of Interest (EoI). 2013 Part: Chap- XXVIII - Special Courts and Chap-

XXIX- Punishments

4. Voting threshold has been brought down to 66

percent from 75 percent for approval of 3. In the Debt and Restructuring Part, Four SEBI

resolution plan, extension of CIRP period, etc. Regulations have been added instead of CDR,

The voting threshold for routine decisions has SDR, S4A (since RBI has withdrawn these

been reduced to 51%. Schemes)

5. Allows participation of security holders, deposit 4. In the General Awareness Part, Constitution of

holders and all other classes of financial creditors India, Right to Constitutional Remedies, Provisions

that exceed a certain number, in meetings of of Union Judiciary, Provisions of High Courts in the

the COC, through the authorized representation. States have been added

6. Section 29(A) of the IBC, 2016 has been modified to 5. The Partnership Act, 1932 now put in the Part of

exempt pure play financial entities from being Indian Contract Act, Sale of Goods Act etc.

disqualified on account of NPA. Similarly, a 6. The % weight age in total marks for each Part is

resolution application holding an NPA by virtue more or less the same, except for Companies Act

of acquiringitin the past under the IBC, 2016, 2013 Part, where 2% is reduced, in the Indian

has been provided with a three-year cooling-off Contract Act, Sale of Goods Act Part 1% increased

period, from the date of such acquisition. and in Finance and Accounts Part 1% increased.

7. The Resolution Applicant to submit an affidavit The Format, Frequency of Examination and

certifying its eligibility to bid since there is wide Examination Fees remaining the same.

range of disqualifications in Section 29(A).

www.dtpa.org Direct Taxes Professionals' Association - Journal | 54