Page 97 - Motor Insurance Ebook IC 72

P. 97

Guide for Motor Insurance

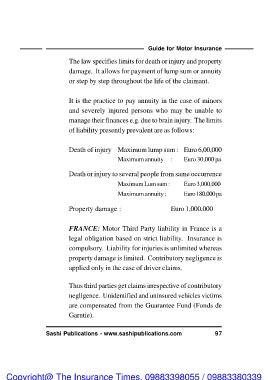

The law specifies limits for death or injury and property

damage. It allows for payment of lump sum or annuity

or step by step throughout the life of the claimant.

It is the practice to pay annuity in the case of minors

and severely injured persons who may be unable to

manage their finances e.g. due to brain injury. The limits

of liability presently prevalent are as follows:

Death of injury Maximum lump sum : Euro 6,00,000

Maximum annuity : Euro 30,000 pa

Death or injury to several people from same occurrence

Maximum Lum sum : Euro 3,000,000

Maximum annuity : Euro 180,000 pa

Property damage : Euro 1,000,000

FRANCE: Motor Third Party liability in France is a

legal obligation based on strict liability. Insurance is

compulsory. Liability for injuries is unlimited whereas

property damage is limited. Contributory negligence is

applied only in the case of driver claims.

Thus third parties get claims irrespective of contributory

negligence. Unidentified and uninsured vehicles victims

are compensated from the Guarantee Fund (Fonds de

Garntie).

Sashi Publications - www.sashipublications.com 97

Copyright@ The Insurance Times. 09883398055 / 09883380339