Page 23 - Insurance Times Janaury 2021

P. 23

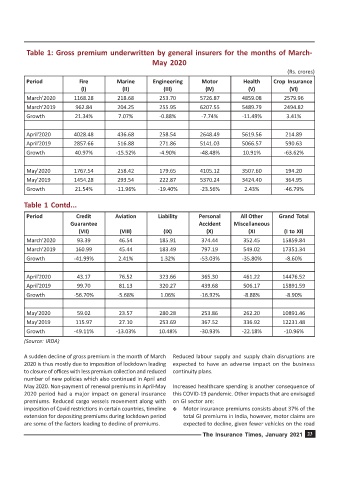

Table 1: Gross premium underwritten by general insurers for the months of March-

May 2020

(Rs. crores)

Period Fire Marine Engineering Motor Health Crop Insurance

(I) (II) (III) (IV) (V) (VI)

March'2020 1168.28 218.68 253.70 5726.87 4859.08 2579.96

March'2019 962.84 204.25 255.95 6207.55 5489.79 2494.82

Growth 21.34% 7.07% -0.88% -7.74% -11.49% 3.41%

April'2020 4028.48 436.68 258.54 2648.49 5619.56 214.89

April'2019 2857.66 516.88 271.86 5141.03 5066.57 590.63

Growth 40.97% -15.52% -4.90% -48.48% 10.91% -63.62%

May'2020 1767.54 258.42 179.65 4105.12 3507.60 194.20

May'2019 1454.28 293.54 222.87 5370.24 3424.40 364.95

Growth 21.54% -11.96% -19.40% -23.56% 2.43% -46.79%

Table 1 Contd...

Period Credit Aviation Liability Personal All Other Grand Total

Guarantee Accident Miscellaneous

(VII) (VIII) (IX) (X) (XI (I to XI)

March'2020 93.39 46.54 185.91 374.44 352.45 15859.84

March'2019 160.99 45.44 183.49 797.19 549.02 17351.34

Growth -41.99% 2.41% 1.32% -53.03% -35.80% -8.60%

April'2020 43.17 76.52 323.66 365.30 461.22 14476.52

April'2019 99.70 81.13 320.27 439.68 506.17 15891.59

Growth -56.70% -5.68% 1.06% -16.92% -8.88% -8.90%

May'2020 59.02 23.57 280.28 253.86 262.20 10891.46

May'2019 115.97 27.10 253.69 367.52 336.92 12231.48

Growth -49.11% -13.03% 10.48% -30.93% -22.18% -10.96%

(Source: IRDA)

A sudden decline of gross premium in the month of March Reduced labour supply and supply chain disruptions are

2020 is thus mostly due to imposition of lockdown leading expected to have an adverse impact on the business

to closure of offices with less premium collection and reduced continuity plans.

number of new policies which also continued in April and

May 2020. Non-payment of renewal premiums in April-May Increased healthcare spending is another consequence of

2020 period had a major impact on general insurance this COVID-19 pandemic. Other impacts that are envisaged

premiums. Reduced cargo vessels movement along with on GI sector are:

imposition of Covid restrictions in certain countries, timeline Y Motor insurance premiums consists about 37% of the

extension for depositing premiums during lockdown period total GI premiums in India, however, motor claims are

are some of the factors leading to decline of premiums. expected to decline, given fewer vehicles on the road

The Insurance Times, January 2021 23