Page 31 - Banking Finance March 2025

P. 31

ARTICLE

Increase in direct tax collection: who took different tax savings scheme.

More thought needs to be given to

The central government levies direct taxes such as personal income tax and

ensuring the economic security of

corporate tax. The government also levies indirect taxes like custom duties,

senior citizens. The old tax regime

excise duties and Goods and Service Tax (GST). The contributions of direct taxes

needed simplification, modernization

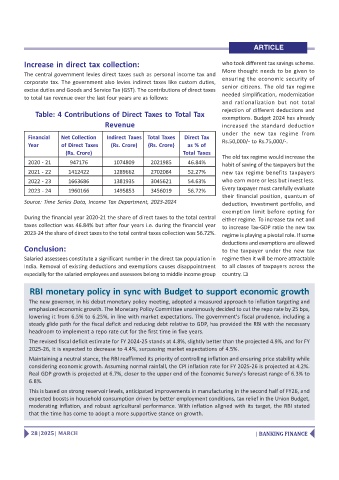

to total tax revenue over the last four years are as follows:

and rationalization but not total

rejection of different deductions and

Table: 4 Contributions of Direct Taxes to Total Tax

exemptions. Budget 2024 has already

Revenue increased the standard deduction

under the new tax regime from

Financial Net Collection Indirect Taxes Total Taxes Direct Tax

Rs.50,000/- to Rs.75,000/-.

Year of Direct Taxes (Rs. Crore) (Rs. Crore) as % of

(Rs. Crore) Total Taxes

The old tax regime would increase the

2020 - 21 947176 1074809 2021985 46.84% habit of saving of the taxpayers but the

2021 - 22 1412422 1289662 2702084 52.27% new tax regime benefits taxpayers

2022 - 23 1663686 1381935 3045621 54.63% who earn more or less but invest less.

Every taxpayer must carefully evaluate

2023 - 24 1960166 1495853 3456019 56.72%

their financial position, quantum of

Source: Time Series Data, Income Tax Department, 2023-2024 deduction, investment portfolio, and

exemption limit before opting for

During the financial year 2020-21 the share of direct taxes to the total central either regime. To increase tax net and

taxes collection was 46.84% but after four years i.e. during the financial year to increase Tax-GDP ratio the new tax

2023-24 the share of direct taxes to the total central taxes collection was 56.72%. regime is playing a pivotal role. If some

deductions and exemptions are allowed

Conclusion: to the taxpayer under the new tax

Salaried assessees constitute a significant number in the direct tax population in regime then it will be more attractable

India. Removal of existing deductions and exemptions causes disappointment to all classes of taxpayers across the

especially for the salaried employees and assessees belong to middle income group country.

RBI monetary policy in sync with Budget to support economic growth

The new governor, in his debut monetary policy meeting, adopted a measured approach to inflation targeting and

emphasized economic growth. The Monetary Policy Committee unanimously decided to cut the repo rate by 25 bps,

lowering it from 6.5% to 6.25%, in line with market expectations. The government's fiscal prudence, including a

steady glide path for the fiscal deficit and reducing debt relative to GDP, has provided the RBI with the necessary

headroom to implement a repo rate cut for the first time in five years.

The revised fiscal deficit estimate for FY 2024-25 stands at 4.8%, slightly better than the projected 4.9%, and for FY

2025-26, it is expected to decrease to 4.4%, surpassing market expectations of 4.5%.

Maintaining a neutral stance, the RBI reaffirmed its priority of controlling inflation and ensuring price stability while

considering economic growth. Assuming normal rainfall, the CPI inflation rate for FY 2025-26 is projected at 4.2%.

Real GDP growth is projected at 6.7%, closer to the upper end of the Economic Survey's forecast range of 6.3% to

6.8%.

This is based on strong reservoir levels, anticipated improvements in manufacturing in the second half of FY26, and

expected boosts in household consumption driven by better employment conditions, tax relief in the Union Budget,

moderating inflation, and robust agricultural performance. With inflation aligned with its target, the RBI stated

that the time has come to adopt a more supportive stance on growth.

28 | 2025 | MARCH | BANKING FINANCE