Page 51 - Insurance Times June 2021

P. 51

Circular

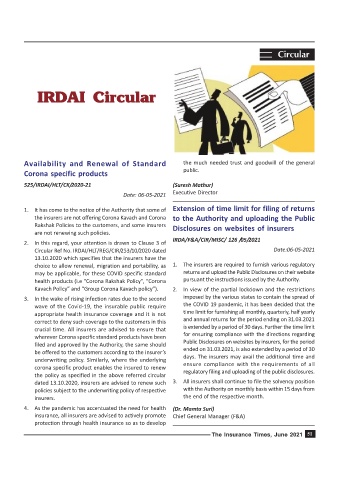

IRDAI Circular

Availability and Renewal of Standard the much needed trust and goodwill of the general

Corona specific products public.

525/IRDAI/HLT/CK/2020-21 (Suresh Mathur)

Date: 06-05-2021 Executive Director

1. It has come to the notice of the Authority that some of Extension of time limit for filing of returns

the insurers are not offering Corona Kavach and Corona to the Authority and uploading the Public

Rakshak Policies to the customers, and some insurers Disclosures on websites of insurers

are not renewing such policies.

IRDA/F&A/CIR/MISC/ 126 /05/2021

2. In this regard, your attention is drawn to Clause 3 of

Circular Ref No. IRDAI/HLT/REG/CIR/253/10/2020 dated Date:06-05-2021

13.10.2020 which specifies that the insurers have the

choice to allow renewal, migration and portability, as 1. The insurers are required to furnish various regulatory

may be applicable, for these COVID specific standard returns and upload the Public Disclosures on their website

health products (i.e “Corona Rakshak Policy”, “Corona pursuant the instructions issued by the Authority.

Kavach Policy” and “Group Corona Kavach policy”). 2. In view of the partial lockdown and the restrictions

3. In the wake of rising infection rates due to the second imposed by the various states to contain the spread of

wave of the Covid-19, the insurable public require the COVID 19 pandemic, it has been decided that the

appropriate health insurance coverage and it is not time limit for furnishing all monthly, quarterly, half yearly

and annual returns for the period ending on 31.03.2021

correct to deny such coverage to the customers in this

crucial time. All insurers are advised to ensure that is extended by a period of 30 days. Further the time limit

for ensuring compliance with the directions regarding

wherever Corona specific standard products have been

Public Disclosures on websites by insurers, for the period

filed and approved by the Authority, the same should

be offered to the customers according to the insurer’s ended on 31.03.2021, is also extended by a period of 30

days. The insurers may avail the additional time and

underwriting policy. Similarly, where the underlying

corona specific product enables the insured to renew ensure compliance with the requirements of all

regulatory filing and uploading of the public disclosures.

the policy as specified in the above referred circular

dated 13.10.2020, insurers are advised to renew such 3. All insurers shall continue to file the solvency position

policies subject to the underwriting policy of respective with the Authority on monthly basis within 15 days from

insurers. the end of the respective month.

4. As the pandemic has accentuated the need for health (Dr. Mamta Suri)

insurance, all insurers are advised to actively promote Chief General Manager (F&A)

protection through health insurance so as to develop

The Insurance Times, June 2021 51