Page 43 - BANKING FINANCE February 2024

P. 43

ARTICLE

Unsecured Retail Credit Market in RBI Apprehension

India:- RBI has observed that, in the last 2 years, unsecured retail

credit has been an outlier segment as far as its growth rate

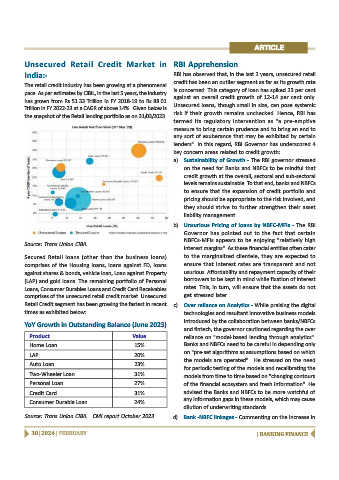

The retail credit industry has been growing at a phenomenal

is concerned. This category of loan has spiked 23 per cent

pace. As per estimates by CIBIL, in the last 5 years, the industry

against an overall credit growth of 12-14 per cent only.

has grown from Rs 51.33 Trillion in FY 2018-19 to Rs 88.01

Unsecured loans, though small in size, can pose systemic

Trillion in FY 2022-23 at a CAGR of above 14%. Given below is

risk if their growth remains unchecked. Hence, RBI has

the snapshot of the Retail lending portfolio as on 31/03/2023.

termed its regulatory intervention as "a pre-emptive

measure to bring certain prudence and to bring an end to

any sort of exuberance that may be exhibited by certain

lenders". In this regard, RBI Governor has underscored 4

key concern areas related to credit growth:

a) Sustainability of Growth - The RBI governor stressed

on the need for Banks and NBFCs to be mindful that

credit growth at the overall, sectoral and sub-sectoral

levels remains sustainable. To that end, banks and NBFCs

to ensure that the expansion of credit portfolio and

pricing should be appropriate to the risk involved, and

they should strive to further strengthen their asset

liability management.

b) Unsurious Pricing of loans by NBFC-MFIs - The RBI

Governor has pointed out to the fact that certain

NBFCs-MFIs appears to be enjoying "relatively high

Source: Trans Union CIBIL.

interest margins". As these financial entities often cater

Secured Retail loans (other than the business loans) to the marginalized clientele, they are expected to

comprises of the Housing loans, loans against FD, loans ensure that interest rates are transparent and not

against shares & bonds, vehicle loan, Loan against Property usurious. Affordability and repayment capacity of their

(LAP) and gold loans. The remaining portfolio of Personal borrowers to be kept in mind while fixation of interest

Loans, Consumer Durables Loans and Credit Card Receivables rates. This, in turn, will ensure that the assets do not

comprises of the unsecured retail credit market. Unsecured get stressed later.

Retail Credit segment has been growing the fastest in recent c) Over reliance on Analytics - While praising the digital

times as exhibited below: technologies and resultant innovative business models

YoY Growth in Outstanding Balance (June 2023) introduced by the collaboration between banks/NBFCs

and fintech, the governor cautioned regarding the over

Product Value reliance on "model-based lending through analytics".

Home Loan 15% Banks and NBFCs need to be careful in depending only

on "pre-set algorithms as assumptions based on which

LAP 20%

the models are operated". He stressed on the need

Auto Loan 23%

for periodic testing of the models and recalibrating the

Two-Wheeler Loan 31% models from time to time based on "changing contours

Personal Loan 27% of the financial ecosystem and fresh information". He

Credit Card 31% advised the Banks and NBFCs to be more watchful of

any information gaps in these models, which may cause

Consumer Durable Loan 24%

dilution of underwriting standards.

Source: Trans Union CIBIL CMI report October 2023 d) Bank -NBFC linkages - Commenting on the increase in

38 | 2024 | FEBRUARY | BANKING FINANCE