Page 8 - Life Insurance Today December 2017

P. 8

10. Premium paying period projected is different from a. IRDA (Protection of Policyholders' Interests)

actual Regulations, 2002

The basic framework for policyholder protection is

11. Surrender value projected is different from Actual

contained in these regulations. Procedure to be

12. Free look refund not paid

followed at the 'point of sale', requirements to be

13. Spurious calls or Hoax calls complied with at the proposal stage and disclosures

14. Advice concerning Exclusions/ limitations of cover not to be made in the life insurance policy are clearly

communicated stated in these Regulations. These Regulations contain

a provision for free look cancellation within 15 days

15. Illegitimate inducements offered

of receipt of policy. On availing of the free look

16. Misappropriation of premiums & Malpractices or cancellation, the insured would be entitled to a refund

unfair business practices of the premium paid. In case of ULIPs, the insured

would also be entitled to repurchase the units at the

The number of complaints relating to unfair business price of the units on the date of cancellation.

practices in life insurance business has come down, while

b. The IRDAI (Insurance Advertisements and Disclosure)

the percentage of unfair business practices complaints has Regulations, 2000

increased. Complaints remain more or less close to 50%.

These regulations require the insurers, agents or

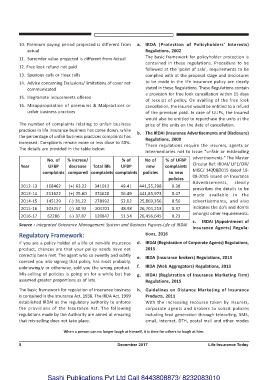

The details are provided in the table below:

intermediaries not to issue "unfair or misleading

advertisements." The Master

No. of % increse/ % of No of % of UFBP

Circular Ref: IRDAI/ LIFE/CIR/

Year UFBP decrease Total life UFBP new complaints

complaints compared complaints complaints policies to new MISC/ 147/08/2015 dated 19-

08-2015 issued on Insurance

policies

Advertisements, clearly

2012-13 168462 (+) 63.22 341012 49.41 441,55,298 0.38

prescribes the details to be

2013-14 211622 (+) 25.60 374620 56.49 441,85,973 0.47 made available in the

2014-15 145129 (-) 31.22 278992 52.02 25,869,356 0.56 advertisements, and also

2015-16 103257 (-) 30.92 204701 48.98 26,704,213 0.37 indicates the do's and don'ts

amongst other requirements.

2016-17 62286 (-) 37.87 120847 51.54 26,456,645 0.23

c. IRDAI (Appointment of

Source : integrated Grievance Management System and Business Figures-Life of IRDAI

Insurance Agents) Regula-

Regulatory Framework: tions, 2016

If you are a policy holder of a life or non-life insurance d. IRDAI (Registration of Corporate Agents) Regulations,

product, chances are that your policy needs have not 2015

correctly been met. The agent who so sweetly and subtly

e. IRDA (Insurance brokers) Regulations, 2013

coerced you into signing that policy, has most probably,

unknowingly or otherwise, sold you the wrong product. f. IRDA (Web Aggregators) Regulations, 2013

Mis-selling of policies is going on for a while but has g. IRDAI (Registration of Insurance Marketing Firm)

assumed greater proportions as of late. Regulations, 2015

The basic framework for regulation of insurance business h. Guidelines on Distance Marketing of Insurance

is contained in the Insurance Act, 1938. The IRDA Act, 1999 Products, 2011

established IRDAI as the regulatory authority to enforce With the increasing recourse taken by insurers,

the provisions of the Insurance Act. The following corporate agents and brokers to solicit policies

regulations made by the Authority are aimed at ensuring including lead generation through telecalling, SMS,

that mis-selling does not take place. email, internet, DTH, postal mail and other modes

When a person can no longer laugh at himself, it is time for others to laugh at him.

8 December 2017 Life Insurance Today

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010