Page 44 - Banking Finance November 2024

P. 44

ARTICLE

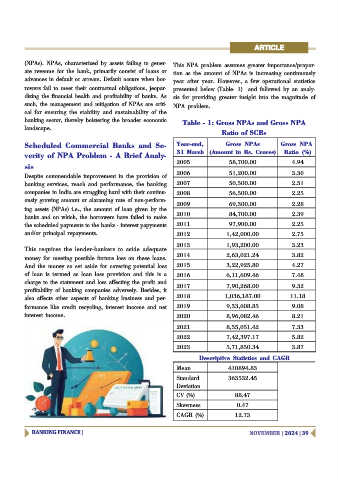

(NPAs). NPAs, characterized by assets failing to gener- This NPA problem assumes greater importance/propor-

ate revenue for the bank, primarily consist of loans or tion as the amount of NPAs is increasing continuously

advances in default or arrears. Default occurs when bor- year after year. However, a few operational statistics

rowers fail to meet their contractual obligations, jeopar- presented below (Table- 1) and followed by an analy-

dizing the financial health and profitability of banks. As sis for providing greater insight into the magnitude of

such, the management and mitigation of NPAs are criti- NPA problem.

cal for ensuring the stability and sustainability of the

banking sector, thereby bolstering the broader economic Table - 1: Gross NPAs and Gross NPA

landscape.

Ratio of SCBs

Scheduled Commercial Banks and Se- Year-end, Gross NPAs Gross NPA

31 March (Amount in Rs. Crores) Ratio (%)

verity of NPA Problem - A Brief Analy-

2005 58,700.00 4.94

sis

2006 51,200.00 3.30

Despite commendable improvement in the provision of

banking services, reach and performance, the banking 2007 50,500.00 2.51

companies in India are struggling hard with their continu- 2008 56,500.00 2.25

ously growing amount or alaraming rate of non-perform-

2009 69,300.00 2.28

ing assets (NPAs) i.e., the amount of loan given by the

2010 84,700.00 2.39

banks and on which, the borrowers have failed to make

the scheduled payments to the banks - interest papyments 2011 97,900.00 2.25

and/or principal repayments. 2012 1,42,000.00 2.75

2013 1,93,200.00 3.23

This requires the lender-bankers to aside adequate

2014 2,63,021.24 3.82

money for meeting possible furture loss on these loans.

And the money so set aside for covering potential loss 2015 3,22,925.80 4.27

of loan is termed as loan loss provision and this is a 2016 6,11,609.46 7.48

charge to the statement and loss affecting the profit and

2017 7,90,268.00 9.32

profitability of banking companies adversely. Besides, it

also affects other aspects of banking business and per- 2018 1,036,187.00 11.18

formance like credit recycling, interest income and net 2019 9,33,608.85 9.08

interest income. 2020 8,96,082.46 8.21

2021 8,35,051.42 7.33

2022 7,42,397.17 5.82

2023 5,71,850.34 3.87

Descriptive Statistics and CAGR

Mean 410894.83

Standard 363532.45

Deviation

CV (%) 88.47

Skewness 0.47

CAGR (%) 12.73

BANKING FINANCE | NOVEMBER | 2024 | 39