Page 35 - Insurance Times May 2019

P. 35

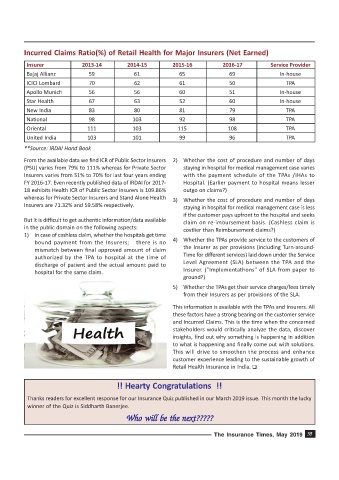

Incurred Claims Ratio(%) of Retail Health for Major Insurers (Net Earned)

Insurer 2013-14 2014-15 2015-16 2016-17 Service Provider

Bajaj Allianz 59 61 65 69 In-house

ICICI Lombard 70 62 61 50 TPA

Apollo Munich 56 56 60 51 In-house

Star Health 67 63 52 60 In-house

New India 83 80 81 79 TPA

National 98 103 92 98 TPA

Oriental 111 103 115 108 TPA

United India 103 101 99 96 TPA

**Source: IRDAI Hand Book

From the available data we find ICR of Public Sector Insurers 2) Whether the cost of procedure and number of days

(PSU) varies from 79% to 111% whereas for Private Sector staying in hospital for medical management case varies

Insurers varies from 51% to 70% for last four years ending with the payment schedule of the TPAs /IHAs to

FY 2016-17. Even recently published data of IRDAI for 2017- Hospital. (Earlier payment to hospital means lesser

18 exhibits Health ICR of Public Sector Insurers is 109.86% outgo on claims?)

whereas for Private Sector Insurers and Stand Alone Health 3) Whether the cost of procedure and number of days

Insurers are 71.32% and 59.58% respectively. staying in hospital for medical management case is less

if the customer pays upfront to the hospital and seeks

But it is difficult to get authentic information/data available claim on re-imbursement basis. (Cashless claim is

in the public domain on the following aspects:

costlier than Reimbursement claims?)

1) In case of cashless claim, whether the hospitals get time

4) Whether the TPAs provide service to the customers of

bound payment from the Insurers; there is no

the Insurer as per provisions (including Turn-around-

mismatch between final approved amount of claim

Time for different services) laid down under the Service

authorized by the TPA to hospital at the time of

discharge of patient and the actual amount paid to Level Agreement (SLA) between the TPA and the

hospital for the same claim. Insurer. ("Implementathons" of SLA from paper to

ground?)

5) Whether the TPAs get their service charges/fees timely

from their Insurers as per provisions of the SLA.

This information is available with the TPAs and Insurers. All

these factors have a strong bearing on the customer service

and Incurred Claims. This is the time when the concerned

stakeholders would critically analyze the data, discover

insights, find out why something is happening in addition

to what is happening and finally come out with solutions.

This will drive to smoothen the process and enhance

customer experience leading to the sustainable growth of

Retail Health Insurance in India. T

!! Hearty Congratulations !!

Thanks readers for excellent response for our Insurance Quiz published in our March 2019 issue. This month the lucky

winner of the Quiz is Siddharth Banerjee.

Who will be the next?????

Who will be the next?????

Who will be the next?????

Who will be the next?????

Who will be the next?????

The Insurance Times, May 2019 35