Page 10 - Life Insurance Today February 2018

P. 10

cannot be covered under the

inherent contract between

doctor and patient, medical

treatment given for weight loss,

plastic surgery, genetic damages

and conditions associated with

AIDS.

Is PI policy mandatory?

In respect of industry bodies'

regulatory requirements, many

business sectors require PI

insurance - accountancy,

engineering and surveying to

name but a few. Professionals

working on a contract basis -

such as management

consultants, business consultants and IT contractors will

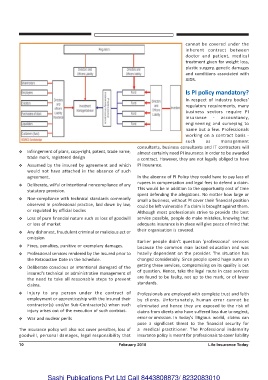

Y Infringement of plans, copy-right, patent, trade name, almost certainly need PI insurance in order to be awarded

trade mark, registered design a contract. However, they are not legally obliged to have

Y Assumed by the insured by agreement and which PI insurance.

would not have attached in the absence of such

agreement. In the absence of PI Policy they could have to pay lacs of

rupees in compensation and legal fees to defend a claim.

Y Deliberate, wilful or intentional noncompliance of any

statutory provision. This would be in addition to the opportunity cost of time

spent defending the allegations. No matter how large or

Y Non-compliance with technical standards commonly small a business, without PI cover their financial position

observed in professional practice, laid down by law, could be left vulnerable if a claim is brought against them.

or regulated by official bodies

Although most professionals strive to provide the best

Y Loss of pure financial nature such as loss of goodwill service possible, people do make mistakes, knowing that

or loss of market adequate insurance is in place will give peace of mind that

Y Any dishonest, fraudulent criminal or malicious act or their organisation is covered.

omission

Earlier people didn't question 'professional' services

Y Fines, penalties, punitive or exemplary damages. because the common man lacked education and was

Y Professional services rendered by the Insured prior to heavily dependent on the provider. The situation has

the Retroactive Date in the Schedule. changed considerably. Since people spend huge sums on

getting these services, compromising on its quality is out

Y Deliberate conscious or intentional disregard of the

of question. Hence, take the legal route in case services

insured's technical or administrative management of

the need to take all reasonable steps to prevent are found to be faulty, not up to the mark, or of lower

claims. standards.

Y Injury to any person under the contract of Professionals are employed with complete trust and faith

employment or apprenticeship with the insured their by clients. Unfortunately, human error cannot be

contractor(s) and/or Sub-Contractor(s) when such eliminated and hence they are exposed to the risk of

injury arises out of the execution of such contract. claims from clients who have suffered loss due to neglect,

Y War and nuclear perils error or omission. In today's litigious world, claims can

pose a significant threat to the financial security for

The insurance policy will also not cover penalties, loss of a medical practitioner. The Professional indemnity

goodwill, personal damages, legal responsibility that insurance policy is meant for professionals to cover liability

10 February 2018 Life Insurance Today

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010