Page 21 - Insurance Times December 2018

P. 21

positions or benefits which they rightfully hold and have a tendency to be averse to business

are not getting them. propositions that are prone to greater risk.

81 interviewees believe that in order to maintain According to 72 interviewees, women get involved

peace and harmony at work, it is important to in low risk businesses as it ensures stability.

negotiate.

Knowledge of liabilities: Women leaders are aware

Balance between personal and professional life: of the liabilities that come as a part with their

Ability to achieve work life balance. position that they hold in the organization

According to 84 interviewees, a balance between 76 interviewees had very less knowledge of

personal and professional life should always be liabilities with respect to their position or

maintained as it improves the efficiency at work designation.

and enjoy life at the same time.

Reducing Attrition Rate: Any effort or special steps

taken by them as leaders to reduce attrition?

According to 77 interviewees, they have taken

certain steps to reduce attrition rate. They try to

become more flexible at meeting their targets by

opting for in-house working schedules.

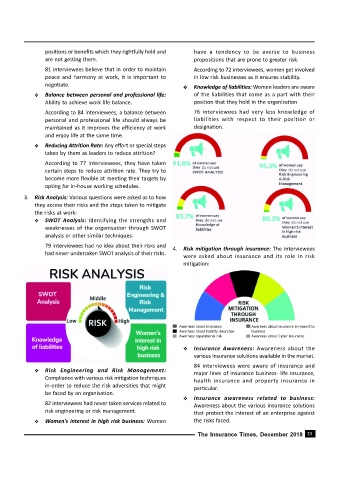

3. Risk Analysis: Various questions were asked as to how

they access their risks and the steps taken to mitigate

the risks at work:

SWOT Analysis: Identifying the strengths and

weaknesses of the organisation through SWOT

analysis or other similar techniques.

79 interviewees had no idea about their risks and

4. Risk mitigation through insurance: The interviewees

had never undertaken SWOT analysis of their risks.

were asked about insurance and its role in risk

mitigation:

Awarness about insurance Awarness about insurance in respect to

Awarness about liability insurance business

Awarness reputational risk Awarness about Cyber Insurance

Insurance Awareness: Awareness about the

various insurance solutions available in the market.

84 interviewees were aware of insurance and

Risk Engineering and Risk Management: major lines of insurance business- life insurance,

Compliance with various risk mitigation techniques

health insurance and property insurance in

in-order to reduce the risk adversities that might

particular.

be faced by an organisation.

Insurance awareness related to business:

82 interviewees had never taken services related to Awareness about the various insurance solutions

risk engineering or risk management. that protect the interest of an enterprise against

Women’s interest in high risk business: Women the risks faced.

The Insurance Times, December 2018 21