Page 27 - Banking Finance June 2025

P. 27

ARTICLE

What are cross border payments? How do Cross Border Payments work

Cross border payments basically refer to transactions where In international money transfers physical currency is not

the payer and the payee are located in different countries. transferred overseas. Neither can transactions in foreign

These payments may be in form of cross border remittances, currency be made through domestic payments system. So,

international trade transactions like exports and imports, to overcome this peculiar problem, international banks do

eCommerce payments or investment transfers. what is called Correspondent Banking. Under this model,

they maintain accounts of foreign banks with them and vice

Table 1: Cross Border Transaction types versa. These accounts are known as the Nostro-Vostro ac-

counts. The funds are credited in the Nostro account in one

Transaction Examples of Cross

country and corresponding amount is debited in the Nostro

types Border Payments

account in another jurisdiction. Let us understand the pro-

Business-to-Business (B2B) International trade cess by way of an example:

transactions transactions like exports

and imports

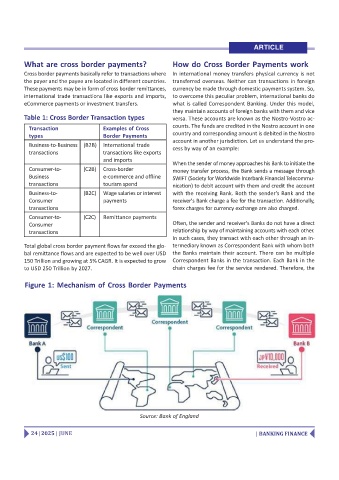

When the sender of money approaches his Bank to initiate the

Consumer-to- (C2B) Cross-border money transfer process, the Bank sends a message through

Business e-commerce and offline SWIFT (Society for Worldwide Interbank Financial Telecommu-

transactions tourism spend nication) to debit account with them and credit the account

Business-to- (B2C) Wage salaries or interest with the receiving Bank. Both the sender's Bank and the

Consumer payments receiver's Bank charge a fee for the transaction. Additionally,

transactions forex charges for currency exchange are also charged.

Consumer-to- (C2C) Remittance payments

Consumer Often, the sender and receiver's Banks do not have a direct

transactions relationship by way of maintaining accounts with each other.

In such cases, they transact with each other through an in-

Total global cross border payment flows far exceed the glo- termediary known as Correspondent Bank with whom both

bal remittance flows and are expected to be well over USD the Banks maintain their account. There can be multiple

150 Trillion and growing at 5% CAGR. It is expected to grow Correspondent Banks in the transaction. Each Bank in the

to USD 250 Trillion by 2027. chain charges fee for the service rendered. Therefore, the

Figure 1: Mechanism of Cross Border Payments

Source: Bank of England

24 | 2025 | JUNE | BANKING FINANCE