Page 24 - Insurance Statistics 2021

P. 24

HANDBOOK ON INDIAN INSURANCE STATISTICS 2019-20

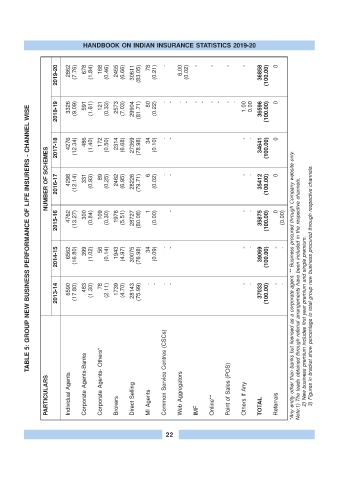

2019-20 2862 (7.76) 678 (1.84) 168 (0.46) 2455 (6.66) 30611 (83.05) 78 (0.21) - 6.00 (0.02) - - - - 36858 (100.00) 0

2018-19 2017-18 3326 4276 (9.09) (12.34) 591 486 (1.61) (1.40) 121 172 (0.33) (0.50) 2573 2314 (7.03) (6.68) 29904 27359 (81.71) (78.98) 80 34 (0.22) (0.10) - - - - - - - - - - - - 1.00 - 0.00 - 36596 34641 (100.00) (100.00) 0 0

TABLE 5: GROUP NEW BUSINESS PERFORMANCE OF LIFE INSURERS - CHANNEL WISE

NUMBER OF SCHEMES 2016-17 2015-16 4298 4762 (12.14) (13.27) 331 300 (0.93) (0.84) 89 109 (0.25) (0.30) 2462 1976 (6.95) (5.51) 28226 28727 (79.71) (80.08) 6 1 (0.02) (0.00) - - - - - - - 35412 35875 (100.00) (100.00) 0 0 (0.00)

2014-15 6562 (16.80) 399 (1.02) 56 (0.14) 1943 (4.97) 30075 (76.98) 34 (0.09) - - - - 39069 (100.00) - -

2013-14 6590 (17.80) 483 (1.30) 78 (2.11) 1739 (4.70) 28143 (75.99) - - - - - - 37033 (100.00) - - *Any entity other than banks but licensed as a corporate agent. ** Business procured through Company website only. Note:1) The leads obtained through referral arrangements have been included in the respective channels. 2) New business premium includes first year premium and single premium. 3) Figures in bracket show pe

PARTICULARS Individual Agents Corporate Agents-Banks Corporate Agents- Others* Brokers Direct Selling MI Agents Common Service Centres (CSCs) Web Aggregators IMF Online** Point of Sales (POS) Others If Any TOTAL Referrals

22