Page 36 - Insurance Times November 2023

P. 36

Opportunities for students and young professionals can move up the ranks quickly and achieve

success.

professionals

If you are a student or young professional interested in a

These new risk exposures, technological advancements, and

scientific developments are creating opportunities for career in the insurance industry, there are a number of

students and young professionals from various fields to come things you can do to prepare yourself. First, focus on

and join the insurance industry. For example, students with developing your technical skills, such as data science,

backgrounds in data science, computer science, and computer science, and engineering. Second, gain experience

engineering are in high demand, as are students with in the insurance industry through internships or part-time

backgrounds in actuarial science, risk management, and jobs. Third, network with insurance professionals and learn

finance. about the different career opportunities available.

The youth hold the key to the industry's future. Their fresh

In addition to technical skills, insurance companies are also perspectives, technological acumen, and adaptability are

looking for young professionals with strong analytical, assets that can help the sector evolve and thrive in an

problem-solving, and communication skills. They are also increasingly complex and interconnected world. To ensure

looking for people who are creative and innovative, and who the continued success of the insurance and reinsurance

are able to think outside the box. industry, there must be a concerted effort to attract, retain,

and empower young professionals who will shape the future

The insurance industry is a great place for students and of risk management and financial security. By embracing the

young professionals to start their careers. It is a stable and potential of youth, the insurance and reinsurance industry

growing industry, and it offers a wide range of career can remain relevant, resilient, and innovative in an ever-

opportunities. With the right skills and experience, young changing world. T

Provide insurance cover to staff travelling in employers' vehicle:

IRDAI tells insurers

Insurance regulator IRDAI asked general insurers to provide cover to employees travelling in employer's vehicle. The

Madras High Court had directed Irdai to make IMT-29 compulsory as an in-built coverage for employees while issuing

a private car policy for such vehicles. IMT stands for India Motor Tariff.

"All general insurers carrying on motor insurance business shall provide the cover to employees travelling in an

employer's vehicle (including paid driver, if applicable) under IMT-29 of the Indian Motor Tariff, compulsorily as an in-

built coverage while issuing private car policy for such vehicles," IRDAI said in a circular.

Insurance Regulatory and Development Authority of India (IRDAI) further said the compulsory cover of IMT-29 should

be provided as an in-built coverage under the Compulsory Motor Third Party Liability Section of Private Car Package/

Bundled Policies and under standalone policies insuring Compulsory Motor Third Party Liability

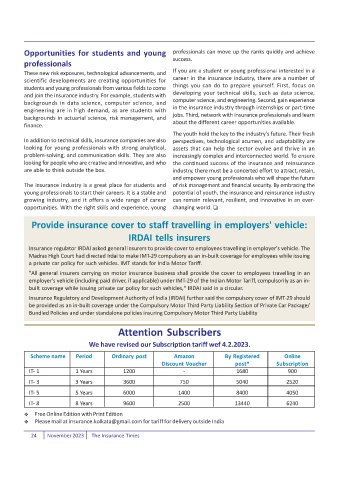

Attention Subscribers

We have revised our Subscription tariff wef 4.2.2023.

Scheme name Period Ordinary post Amazon By Registered Online

Discount Voucher post* Subscription

IT- 1 1 Years 1200 - 1680 900

IT- 3 3 Years 3600 750 5040 2520

IT- 5 5 Years 6000 1400 8400 4050

IT- 8 8 Years 9600 2500 13440 6240

Y Free Online Edition with Print Edition

Y Please mail at insurance.kolkata@gmail.com for tariff for delivery outside India

24 November 2023 The Insurance Times