Page 24 - Insurance Times April 2020

P. 24

1. Artificial Intelligence can build machines to process data and learn on their own,

AI has transformed the insurance industry in a short period. without our constant supervision."

The technology has reduced labour costs and increased the

efficiency of claims processing. Some Insurers have started Machine learning is capable of not only improving claims

looking at AI-based solutions to retain existing and attract processing but also automating it. When claim files are in

new customers. This can be achieved by offering the best digital form and accessible via the cloud, they can be

possible services that will delight the customers across analysedby using pre-programmed algorithms which result

channels. in improving processing speed and accuracy. This automated

review can also be used for policy administration and risk

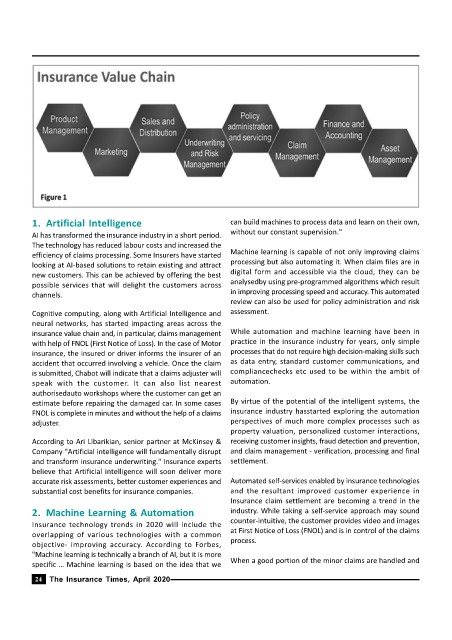

Cognitive computing, along with Artificial Intelligence and assessment.

neural networks, has started impacting areas across the

insurance value chain and, in particular, claims management While automation and machine learning have been in

with help of FNOL (First Notice of Loss). In the case of Motor practice in the insurance industry for years, only simple

insurance, the insured or driver informs the insurer of an processes that do not require high decision-making skills such

accident that occurred involving a vehicle. Once the claim as data entry, standard customer communications, and

is submitted, Chabot will indicate that a claims adjuster will compliancechecks etc used to be within the ambit of

speak with the customer. It can also list nearest automation.

authorisedauto workshops where the customer can get an

estimate before repairing the damaged car. In some cases By virtue of the potential of the intelligent systems, the

FNOL is complete in minutes and without the help of a claims insurance industry hasstarted exploring the automation

adjuster. perspectives of much more complex processes such as

property valuation, personalized customer interactions,

According to Ari Libarikian, senior partner at McKinsey & receiving customer insights, fraud detection and prevention,

Company "Artificial intelligence will fundamentally disrupt and claim management - verification, processing and final

and transform insurance underwriting." Insurance experts settlement.

believe that Artificial intelligence will soon deliver more

accurate risk assessments, better customer experiences and Automated self-services enabled by insurance technologies

substantial cost benefits for insurance companies. and the resultant improved customer experience in

Insurance claim settlement are becoming a trend in the

2. Machine Learning & Automation industry. While taking a self-service approach may sound

Insurance technology trends in 2020 will include the counter-intuitive, the customer provides video and images

overlapping of various technologies with a common at First Notice of Loss (FNOL) and is in control of the claims

objective- improving accuracy. According to Forbes, process.

"Machine learning is technically a branch of AI, but it is more

specific … Machine learning is based on the idea that we When a good portion of the minor claims are handled and

24 The Insurance Times, April 2020