Page 8 - Insurance Times April 2020

P. 8

of premium collection of Rs 4 lakh crore the terms and conditions of fire the insurance despite the lockdown.

by FY25. Presently the premium insurance policies, the cover ceases to “The policyholders are complaining that

collection is standing at Rs 2 lakh crore. exist if the premises are unoccupied for the absence of any competition is

In FY19, non-life penetration stood at a period of 30 days. leading to a multifold increase in

0.97%. GI Council has also launched an Due to the lockdown, factories/ insurance premiums (with all insurers

awareness and education campaign - warehouses and commercial quoting the same price in a de-tariffed

Faayde Ki Baat. establishments have been unoccupied market), application of COVID-19

Though the penetration (non-life) in this since March 24. While the general exclusions unilaterally, and now,

period has increased from about 0.5% insurers have said COVID-19 will be coverage continuity being put under

of GDP (in 2000) to 1% of GDP treated as a special situation and cover doubt,” it said in the letter.

(presently), this is far below the Asian will not be explicitly denied, a lot of General Insurers have advised various

penetration of 1.85% and global restrictions have been attached. policyholders based on the guidance

penetration of 2.8% to GDP. Insurance Companies consent also need received from GIC Re that continuity of

AV Girija Kumar, Chairman, GI Council, to be taken in advance for policy size of cover is subject to compliance of

said , “The idea is to help deepen the over Rs 5 crore where a decision will be specified conditions during lockdown

reach of personal lines of business of taken by the insurance company on a period and prior written approval of

non-life insurers and focus on smaller case-to-case basis whether the cover insurer needs to be taken for continuity

towns.” will be extended or not. of cover.

Business Owners in This means that in case of a fire or theft The fire insurance rates for 291

in large commercial premises (with

occupancies have been revised from

dilemma over coverage of insurance above Rs 5 crore) during a January 1 onwards. Despite this, claim

business interruption lockdown, claims will not be paid unless payments could be a bone of contention.

prior consent has been sought.

losses under COVID-19 On April 27, Insurance Brokers IBAI has asked the IRDAI to issue

necessary directions. However, sources

The COVID-19 has brought new Association of India wrote a letter to said insurers and reinsurers would be

challenges for business owners in terms the IRDAI Chairman seeking reprieve given the right to take a decision on this

of continuity of Insurance Cover. As per from the COVID-19 exclusions and matter.

sought that continuity be provided in

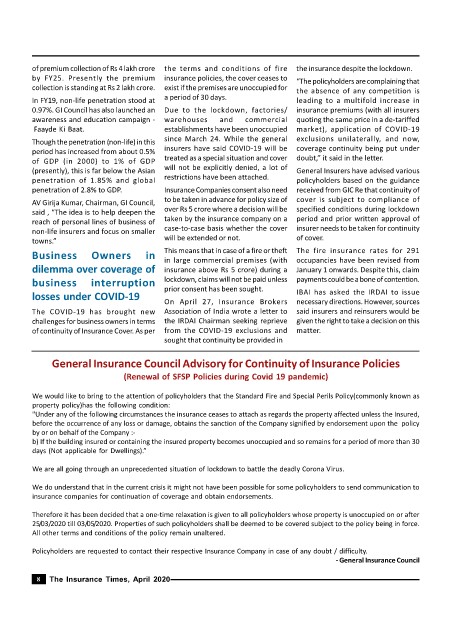

General Insurance Council Advisory for Continuity of Insurance Policies

(Renewal of SFSP Policies during Covid 19 pandemic)

We would like to bring to the attention of policyholders that the Standard Fire and Special Perils Policy(commonly known as

property policy)has the following condition:

"Under any of the following circumstances the insurance ceases to attach as regards the property affected unless the Insured,

before the occurrence of any loss or damage, obtains the sanction of the Company signified by endorsement upon the policy

by or on behalf of the Company :-

b) If the building insured or containing the insured property becomes unoccupied and so remains for a period of more than 30

days (Not applicable for Dwellings).”

We are all going through an unprecedented situation of lockdown to battle the deadly Corona Virus.

We do understand that in the current crisis it might not have been possible for some policyholders to send communication to

insurance companies for continuation of coverage and obtain endorsements.

Therefore it has been decided that a one-time relaxation is given to all policyholders whose property is unoccupied on or after

25/03/2020 till 03/05/2020. Properties of such policyholders shall be deemed to be covered subject to the policy being in force.

All other terms and conditions of the policy remain unaltered.

Policyholders are requested to contact their respective Insurance Company in case of any doubt / difficulty.

- General Insurance Council

8 The Insurance Times, April 2020