Page 2 - Private Wealth Core Moderate PDF Factsheet

P. 2

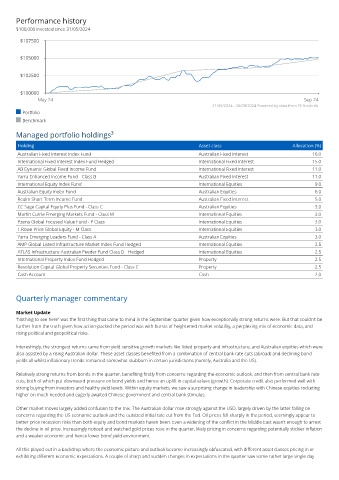

Performance history

$100,000 invested since 31/05/2024

$107500

$105000

$102500

$100000

May 24 Sep 24

31/05/2024 - 30/09/2024 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

Australian Fixed Interest Index Fund Australian Fixed Interest 16.0

International Fixed Interest Index Fund Hedged International Fixed Interest 15.0

AB Dynamic Global Fixed Income Fund International Fixed Interest 11.0

Yarra Enhanced Income Fund - Class B Australian Fixed Interest 11.0

International Equity Index Fund International Equities 9.0

Australian Equity Index Fund Australian Equities 6.0

Realm Short Term Income Fund Australian Fixed Interest 5.0

CC Sage Capital Equity Plus Fund - Class C Australian Equities 3.0

Martin Currie Emerging Markets Fund - Class M International Equities 3.0

Pzena Global Focused Value Fund - P Class International Equities 3.0

T.Rowe Price Global Equity - M Class International Equities 3.0

Yarra Emerging Leaders Fund - Class A Australian Equities 3.0

AMP Global Listed Infrastructure Market Index Fund Hedged International Equities 2.5

ATLAS Infrastructure Australian Feeder Fund Class D - Hedged International Equities 2.5

International Property Index Fund Hedged Property 2.5

Resolution Capital Global Property Securities Fund - Class C Property 2.5

Cash Account Cash 2.0

Quarterly manager commentary

Market Update

“Nothing to see here” was the first thing that came to mind in the September quarter given how exceptionally strong returns were. But that couldn’t be

further from the truth given how action-packed the period was with bursts of heightened market volatility, a perplexing mix of economic data, and

rising political and geopolitical risks.

Interestingly, the strongest returns came from yield sensitive growth markets like listed property and infrastructure, and Australian equities which were

also assisted by a rising Australian dollar. These asset classes benefited from a combination of central bank rate cuts (abroad) and declining bond

yields all whilst inflationary trends remained somewhat stubborn in certain jurisdictions (namely, Australia and the US).

Relatively strong returns from bonds in the quarter, benefiting firstly from concerns regarding the economic outlook, and then from central bank rate

cuts, both of which put downward pressure on bond yields and hence an uplift in capital values (growth). Corporate credit also performed well with

strong buying from investors and healthy yield levels. Within equity markets, we saw a surprising change in leadership with Chinese equities rocketing

higher on much needed and eagerly awaited Chinese government and central bank stimulus.

Other market moves largely added confusion to the mix. The Australian dollar rose strongly against the USD, largely driven by the latter falling on

concerns regarding the US economic outlook and the outsized initial rate cut from the Fed. Oil prices fell sharply in the period, seemingly appear to

better price recession risks than both equity and bond markets haven been. Even a widening of the conflict in the Middle East wasn’t enough to arrest

the decline in oil price. Increasingly noticed and watched gold prices rose in the quarter, likely pricing in concerns regarding potentially stickier inflation

and a weaker economic and hence lower bond yield environment.

All this played out in a backdrop where the economic picture and outlook became increasingly obfuscated, with different asset classes pricing in or

exhibiting different economic expectations. A couple of sharp and sudden changes in expectations in the quarter saw some rather large single day