Page 2 - Private Wealth Specialist Growth Assertive PDF Factsheet

P. 2

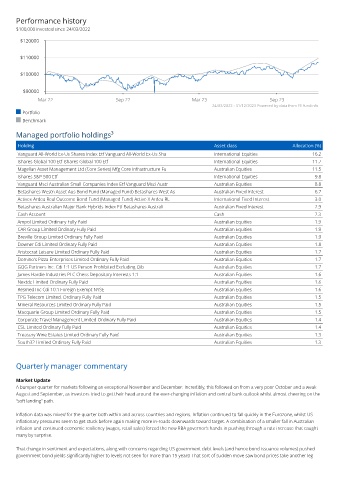

Performance history

$100,000 invested since 24/03/2022

$120000

$110000

$100000

$90000

Mar 22 Sep 22 Mar 23 Sep 23

24/03/2022 - 31/12/2023 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

Vanguard All-World Ex-Us Shares Index Etf Vanguard All-World Ex-Us Sha International Equities 16.2

Ishares Global 100 Etf Ishares Global 100 Etf International Equities 11.7

Magellan Asset Management Ltd (Core Series) Mfg Core Infrastructure Fu Australian Equities 11.5

Ishares S&P 500 Etf International Equities 9.8

Vanguard Msci Australian Small Companies Index Etf Vanguard Msci Austr Australian Equities 8.8

Betashares Westn Asset Aus Bond Fund (Managed Fund) Betashares West As Australian Fixed Interest 6.7

Activex Ardea Real Outcome Bond Fund (Managed Fund) Active X Ardea RL International Fixed Interest 3.0

Betashares Australian Major Bank Hybrids Index Etf Betashares Australi Australian Fixed Interest 2.9

Cash Account Cash 2.3

Ampol Limited Ordinary Fully Paid Australian Equities 1.9

CAR Group Limited Ordinary Fully Paid Australian Equities 1.9

Breville Group Limited Ordinary Fully Paid Australian Equities 1.9

Downer Edi Limited Ordinary Fully Paid Australian Equities 1.8

Aristocrat Leisure Limited Ordinary Fully Paid Australian Equities 1.7

Domino's Pizza Enterprises Limited Ordinary Fully Paid Australian Equities 1.7

GQG Partners Inc. Cdi 1:1 US Person Prohibited Excluding Qib Australian Equities 1.7

James Hardie Industries PLC Chess Depositary Interests 1:1 Australian Equities 1.6

Nextdc Limited Ordinary Fully Paid Australian Equities 1.6

Resmed Inc Cdi 10:1 Foreign Exempt NYSE Australian Equities 1.6

TPG Telecom Limited. Ordinary Fully Paid Australian Equities 1.5

Mineral Resources Limited Ordinary Fully Paid Australian Equities 1.5

Macquarie Group Limited Ordinary Fully Paid Australian Equities 1.5

Corporate Travel Management Limited Ordinary Fully Paid Australian Equities 1.4

CSL Limited Ordinary Fully Paid Australian Equities 1.4

Treasury Wine Estates Limited Ordinary Fully Paid Australian Equities 1.3

South32 Limited Ordinary Fully Paid Australian Equities 1.3

Quarterly manager commentary

Market Update

A bumper quarter for markets following an exceptional November and December. Incredibly, this followed on from a very poor October and a weak

August and September, as investors tried to get their head around the ever-changing inflation and central bank outlook whilst almost cheering on the

“soft landing” path.

Inflation data was mixed for the quarter both within and across countries and regions. Inflation continued to fall quickly in the Eurozone, whilst US

inflationary pressures seem to get stuck before again making more in-roads downwards toward target. A combination of a smaller fall in Australian

inflation and continued economic resiliency (wages, retail sales) forced the new RBA governor’s hands in pushing through a rate increase that caught

many by surprise.

That change in sentiment and expectations, along with concerns regarding US government debt levels (and hence bond issuance volumes) pushed

government bond yields significantly higher to levels not seen for more than 15 years! That sort of sudden move saw bond prices take another leg