Page 2 - SAM TEST

P. 2

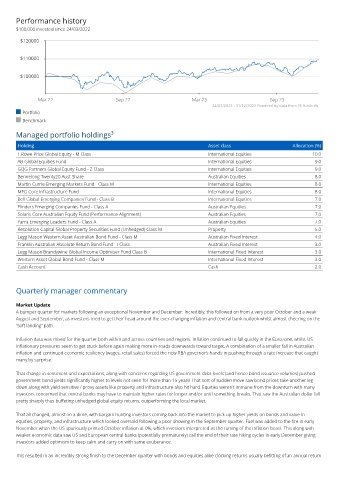

Performance history

$100,000 invested since 24/03/2022

$120000

$110000

$100000

Mar 22 Sep 22 Mar 23 Sep 23

24/03/2022 - 31/12/2023 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

T.Rowe Price Global Equity - M Class International Equities 10.0

AB Global Equities Fund International Equities 9.0

GQG Partners Global Equity Fund - Z Class International Equities 9.0

Bennelong Twenty20 Aust Share Australian Equities 8.0

Martin Currie Emerging Markets Fund - Class M International Equities 8.0

MFG Core Infrastructure Fund International Equities 8.0

Bell Global Emerging Companies Fund - Class B International Equities 7.0

Flinders Emerging Companies Fund - Class A Australian Equities 7.0

Solaris Core Australian Equity Fund (Performance Alignment) Australian Equities 7.0

Yarra Emerging Leaders Fund - Class A Australian Equities 7.0

Resolution Capital Global Property Securities Fund (Unhedged) Class M Property 5.0

Legg Mason Western Asset Australian Bond Fund - Class M Australian Fixed Interest 4.0

Franklin Australian Absolute Return Bond Fund - I Class Australian Fixed Interest 3.0

Legg Mason Brandywine Global Income Optimiser Fund Class B International Fixed Interest 3.0

Western Asset Global Bond Fund - Class M International Fixed Interest 3.0

Cash Account Cash 2.0

Quarterly manager commentary

Market Update

A bumper quarter for markets following an exceptional November and December. Incredibly, this followed on from a very poor October and a weak

August and September, as investors tried to get their head around the ever-changing inflation and central bank outlook whilst almost cheering on the

“soft landing” path.

Inflation data was mixed for the quarter both within and across countries and regions. Inflation continued to fall quickly in the Eurozone, whilst US

inflationary pressures seem to get stuck before again making more in-roads downwards toward target. A combination of a smaller fall in Australian

inflation and continued economic resiliency (wages, retail sales) forced the new RBA governor’s hands in pushing through a rate increase that caught

many by surprise.

That change in sentiment and expectations, along with concerns regarding US government debt levels (and hence bond issuance volumes) pushed

government bond yields significantly higher to levels not seen for more than 15 years! That sort of sudden move saw bond prices take another leg

down along with yield sensitive / proxy assets like property and infrastructure also hit hard. Equities weren’t immune from the downturn with many

investors concerned that central banks may have to maintain higher rates for longer and/or until something breaks. That saw the Australian dollar fall

pretty sharply thus buffeting unhedged global equity returns, outperforming the local market.

That all changed, almost on a dime, with bargain hunting investors coming back into the market to pick up higher yields on bonds and value in

equities, property, and infrastructure which looked oversold following a poor showing in the September quarter. Fuel was added to the fire in early

November when the US spuriously printed October inflation at 0%, which investors interpreted as the taming of the inflation beast. This along with

weaker economic data saw US and European central banks (potentially prematurely) call the end of their rate hiking cycles in early December giving

investors added optimism to keep calm and carry on with same exuberance.

This resulted in an incredibly strong finish to the December quarter with bonds and equities alike clocking returns usually befitting of an annual return