Page 2 - Private Wealth Best of Breed Moderate

P. 2

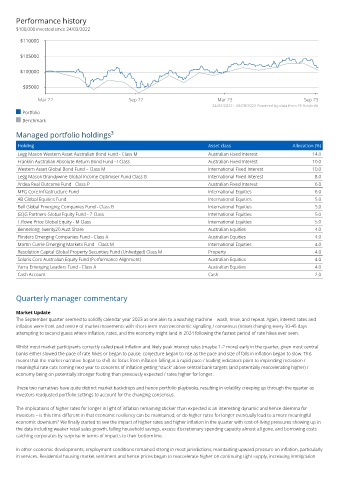

Performance history

$100,000 invested since 24/03/2022

$110000

$105000

$100000

$95000

Mar 22 Sep 22 Mar 23 Sep 23

24/03/2022 - 30/09/2023 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

Legg Mason Western Asset Australian Bond Fund - Class M Australian Fixed Interest 14.0

Franklin Australian Absolute Return Bond Fund - I Class Australian Fixed Interest 10.0

Western Asset Global Bond Fund – Class M International Fixed Interest 10.0

Legg Mason Brandywine Global Income Optimiser Fund Class B International Fixed Interest 8.0

Ardea Real Outcome Fund - Class P Australian Fixed Interest 6.0

MFG Core Infrastructure Fund International Equities 6.0

AB Global Equities Fund International Equities 5.0

Bell Global Emerging Companies Fund - Class B International Equities 5.0

GQG Partners Global Equity Fund - Z Class International Equities 5.0

T.Rowe Price Global Equity - M Class International Equities 5.0

Bennelong Twenty20 Aust Share Australian Equities 4.0

Flinders Emerging Companies Fund - Class A Australian Equities 4.0

Martin Currie Emerging Markets Fund - Class M International Equities 4.0

Resolution Capital Global Property Securities Fund (Unhedged) Class M Property 4.0

Solaris Core Australian Equity Fund (Performance Alignment) Australian Equities 4.0

Yarra Emerging Leaders Fund - Class A Australian Equities 4.0

Cash Account Cash 2.0

Quarterly manager commentary

Market Update

The September quarter seemed to solidify calendar year 2023 as one akin to a washing machine – wash, rinse, and repeat. Again, interest rates and

inflation were front and centre of market movements with short-term macroeconomic signalling / consensus (noise) changing every 30-45 days

attempting to second guess where inflation, rates, and the economy might land in 2024 following the fastest period of rate hikes ever seen.

Whilst most market participants correctly called peak inflation and likely peak interest rates (maybe 1-2 more) early in the quarter, given most central

banks either slowed the pace of rate hikes or began to pause, conjecture began to rise as the pace and size of falls in inflation began to slow. This

meant that the market narrative began to shift its focus from inflation falling at a rapid pace / leading indicators point to impending recession /

meaningful rate cuts coming next year to concerns of inflation getting “stuck” above central bank targets (and potentially reaccelerating higher) /

economy being on potentially stronger footing than previously expected / rates higher for longer.

These two narratives have quite distinct market backdrops and hence portfolio playbooks, resulting in volatility creeping up through the quarter as

investors readjusted portfolio settings to account for the changing consensus.

The implications of higher rates for longer in light of inflation remaining stickier than expected is an interesting dynamic and hence dilemma for

investors – is this time different in that economic resiliency can be maintained; or do higher rates for longer eventually lead to a more meaningful

economic downturn? We finally started to see the impact of higher rates and higher inflation in the quarter with cost-of-living pressures showing up in

the data including weaker retail sales growth, falling household savings, excess discretionary spending capacity almost all gone, and borrowing costs

catching corporates by surprise in terms of impacts to their bottom line.

In other economic developments, employment conditions remained strong in most jurisdictions, maintaining upward pressure on inflation, particularly

in services. Residential housing market sentiment and hence prices began to reaccelerate higher on continuing tight supply, increasing immigration