Page 2 - SMA Portfolio Growth Moderate 18.11.22

P. 2

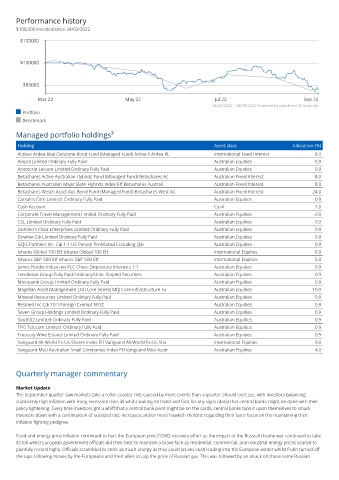

Performance history

$100,000 invested since 24/03/2022

$105000

$100000

$95000

Mar 22 May 22 Jul 22 Sep 22

24/03/2022 - 30/09/2022 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

Activex Ardea Real Outcome Bond Fund (Managed Fund) Active X Ardea RL International Fixed Interest 8.0

Ampol Limited Ordinary Fully Paid Australian Equities 0.9

Aristocrat Leisure Limited Ordinary Fully Paid Australian Equities 0.9

Betashares Active Australian Hybrids Fund (Managed Fund) Betashares Ac Australian Fixed Interest 8.0

Betashares Australian Major Bank Hybrids Index Etf Betashares Australi Australian Fixed Interest 8.0

Betashares Westn Asset Aus Bond Fund (Managed Fund) Betashares West As Australian Fixed Interest 24.0

Carsales.Com Limited. Ordinary Fully Paid Australian Equities 0.9

Cash Account Cash 2.0

Corporate Travel Management Limited Ordinary Fully Paid Australian Equities 0.9

CSL Limited Ordinary Fully Paid Australian Equities 0.9

Domino's Pizza Enterprises Limited Ordinary Fully Paid Australian Equities 0.9

Downer Edi Limited Ordinary Fully Paid Australian Equities 0.9

GQG Partners Inc. Cdi 1:1 US Person Prohibited Excluding Qib Australian Equities 0.9

Ishares Global 100 Etf Ishares Global 100 Etf International Equities 6.0

Ishares S&P 500 Etf Ishares S&P 500 Etf International Equities 5.0

James Hardie Industries PLC Chess Depositary Interests 1:1 Australian Equities 0.9

Lendlease Group Fully Paid Ordinary/Units Stapled Securities Australian Equities 0.9

Macquarie Group Limited Ordinary Fully Paid Australian Equities 0.9

Magellan Asset Management Ltd (Core Series) Mfg Core Infrastructure Fu Australian Equities 10.0

Mineral Resources Limited Ordinary Fully Paid Australian Equities 0.9

Resmed Inc Cdi 10:1 Foreign Exempt NYSE Australian Equities 0.9

Seven Group Holdings Limited Ordinary Fully Paid Australian Equities 0.9

South32 Limited Ordinary Fully Paid Australian Equities 0.9

TPG Telecom Limited. Ordinary Fully Paid Australian Equities 0.9

Treasury Wine Estates Limited Ordinary Fully Paid Australian Equities 0.9

Vanguard All-World Ex-Us Shares Index Etf Vanguard All-World Ex-Us Sha International Equities 9.0

Vanguard Msci Australian Small Companies Index Etf Vanguard Msci Austr Australian Equities 4.0

Quarterly manager commentary

Market Update

The September quarter saw markets take a roller-coaster ride caused by more events than a quarter should ever see, with investors balancing

stubbornly high inflation with rising recession risks all whilst waiting on hand and foot for any signs (data) that central banks might be done with their

policy tightening. Every time investors got a whiff that a central bank pivot might be on the cards, central banks took it upon themselves to smack

investors down with a continuation of outsized rate increases and/or more hawkish rhetoric regarding their laser focus on the maintaining their

inflation fighting pedigree.

Food and energy price inflation continued to hurt the European post-COVID recovery effort as the impact of the Russia/Ukraine war continued to take

its toll whilst European government officials did their best to maintain a brave face as residential, commercial, and industrial energy prices soared to

painfully record highs. Officials scrambled to store as much energy as they could (at any cost) leading into the European winter whilst Putin turned off

the taps following moves by the Europeans and their allies to cap the price of Russian gas. This was followed by an attack on those same Russian