Page 2 - Private Wealth Best of Breed Assertive

P. 2

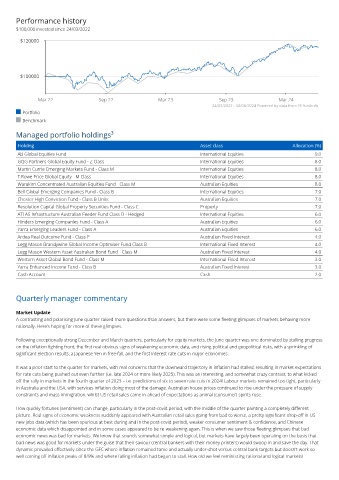

Performance history

$100,000 invested since 24/03/2022

$120000

$100000

Mar 22 Sep 22 Mar 23 Sep 23 Mar 24

24/03/2022 - 30/06/2024 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

AB Global Equities Fund International Equities 9.0

GQG Partners Global Equity Fund - Z Class International Equities 8.0

Martin Currie Emerging Markets Fund - Class M International Equities 8.0

T.Rowe Price Global Equity - M Class International Equities 8.0

Warakirri Concentrated Australian Equities Fund - Class M Australian Equities 8.0

Bell Global Emerging Companies Fund - Class B International Equities 7.0

Chester High Conviction Fund - Class B Units Australian Equities 7.0

Resolution Capital Global Property Securities Fund - Class C Property 7.0

ATLAS Infrastructure Australian Feeder Fund Class D - Hedged International Equities 6.0

Flinders Emerging Companies Fund - Class A Australian Equities 6.0

Yarra Emerging Leaders Fund - Class A Australian Equities 6.0

Ardea Real Outcome Fund - Class P Australian Fixed Interest 4.0

Legg Mason Brandywine Global Income Optimiser Fund Class B International Fixed Interest 4.0

Legg Mason Western Asset Australian Bond Fund - Class M Australian Fixed Interest 4.0

Western Asset Global Bond Fund - Class M International Fixed Interest 3.0

Yarra Enhanced Income Fund - Class B Australian Fixed Interest 3.0

Cash Account Cash 2.0

Quarterly manager commentary

Market Update

A contrasting and polarising June quarter raised more questions than answers, but there were some fleeting glimpses of markets behaving more

rationally. Here’s hoping for more of these glimpses.

Following exceptionally strong December and March quarters, particularly for equity markets, the June quarter was one dominated by stalling progress

on the inflation fighting front, the first real obvious signs of weakening economic data, and rising political and geopolitical risks, with a sprinkling of

significant election results, a Japanese Yen in free-fall, and the first interest rate cuts in major economies.

It was a poor start to the quarter for markets, with real concerns that the downward trajectory in inflation had stalled, resulting in market expectations

for rate cuts being pushed out even further (i.e. late 2024 or more likely 2025). This was an interesting, and somewhat crazy contrast, to what kicked

off the rally in markets in the fourth quarter of 2023 – i.e. predictions of six to seven rate cuts in 2024! Labour markets remained too tight, particularly

in Australia and the USA, with services inflation doing most of the damage. Australian house prices continued to rise under the pressure of supply

constraints and mass immigration, whilst US retail sales came in ahead of expectations as animal (consumer) spirits rose.

How quickly fortunes (sentiment) can change, particularly in the post-covid period, with the middle of the quarter painting a completely different

picture. Real signs of economic weakness suddenly appeared with Australian retail sales going from bad to worse, a pretty significant drop-off in US

new jobs data (which has been spurious at best during and in the post-covid period), weaker consumer sentiment & confidence, and Chinese

economic data which disappointed and in some cases appeared to be re-weakening again. This is when we saw those fleeting glimpses that bad

economic news was bad for markets. We know that sounds somewhat simple and logical, but markets have largely been operating on the basis that

bad news was good for markets under the guise that their saviour (central bankers with their money printers) would swoop in and save the day. That

dynamic prevailed effectively since the GFC where inflation remained tame and actually under-shot versus central bank targets but doesn’t work so

well coming off inflation peaks of 8/9% and where falling inflation had begun to stall. How old we feel reminiscing rational and logical markets!