Page 2 - Private Wealth Best of Breed Moderate

P. 2

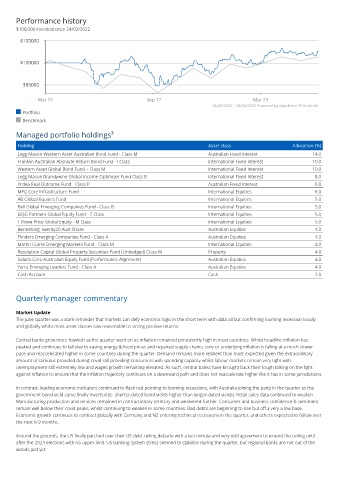

Performance history

$100,000 invested since 24/03/2022

$105000

$100000

$95000

Mar 22 Sep 22 Mar 23

24/03/2022 - 30/06/2023 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

Legg Mason Western Asset Australian Bond Fund - Class M Australian Fixed Interest 14.0

Franklin Australian Absolute Return Bond Fund - I Class International Fixed Interest 10.0

Western Asset Global Bond Fund – Class M International Fixed Interest 10.0

Legg Mason Brandywine Global Income Optimiser Fund Class B International Fixed Interest 8.0

Ardea Real Outcome Fund - Class P Australian Fixed Interest 6.0

MFG Core Infrastructure Fund International Equities 6.0

AB Global Equities Fund International Equities 5.0

Bell Global Emerging Companies Fund - Class B International Equities 5.0

GQG Partners Global Equity Fund - Z Class International Equities 5.0

T.Rowe Price Global Equity - M Class International Equities 5.0

Bennelong Twenty20 Aust Share Australian Equities 4.0

Flinders Emerging Companies Fund - Class A Australian Equities 4.0

Martin Currie Emerging Markets Fund - Class M International Equities 4.0

Resolution Capital Global Property Securities Fund (Unhedged) Class M Property 4.0

Solaris Core Australian Equity Fund (Performance Alignment) Australian Equities 4.0

Yarra Emerging Leaders Fund - Class A Australian Equities 4.0

Cash Account Cash 2.0

Quarterly manager commentary

Market Update

The June quarter was a stark reminder that markets can defy economic logic in the short term with data all but confirming looming recession locally

and globally whilst most asset classes saw reasonable to strong positive returns.

Central banks grew more hawkish as the quarter went on as inflation remained persistently high in most countries. Whilst headline inflation has

peaked and continues to fall due to easing energy & food prices and repaired supply chains, core or underlying inflation is falling at a much slower

pace and reaccelerated higher in some countries during the quarter. Demand remains more resilient than most expected given the extraordinary

amount of stimulus provided during covid still providing consumers with spending capacity whilst labour markets remain very tight with

unemployment still extremely low and wages growth remaining elevated. As such, central banks have brought back their tough talking on the fight

against inflation to ensure that the inflation trajectory continues on a downward path and does not reaccelerate higher like it has in some jurisdictions.

In contrast, leading economic indicators continued to flash red pointing to looming recessions, with Australia joining the party in the quarter as the

government bond yield curve finally inverted (ie. shorter-dated bond yields higher than longer-dated yields). Retail sales data continued to weaken.

Manufacturing production and services remained in contractionary territory and weakened further. Consumer and business confidence & sentiment

remain well below their covid peaks, whilst continuing to weaken in some countries. Bad debts are beginning to rise but off a very a low base.

Economic growth continues to contract globally with Germany and NZ entering technical recessions in the quarter, and others expected to follow over

the next 6-9 months.

Around the grounds, the US finally patched over their US debt ceiling debacle with a last minute and very odd agreement to extend the ceiling until

after the 2024 elections with no upper limit. US banking system stress seemed to stabilise during the quarter, but regional banks are not out of the

woods just yet.