Page 2 - Private Wealth Best of Breed Assertive PDF Factsheet

P. 2

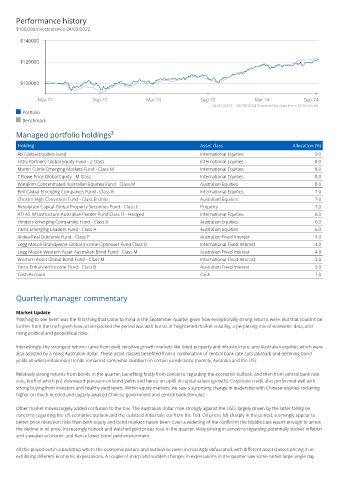

Performance history

$100,000 invested since 24/03/2022

$140000

$120000

$100000

Mar 22 Sep 22 Mar 23 Sep 23 Mar 24 Sep 24

24/03/2022 - 30/09/2024 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

AB Global Equities Fund International Equities 9.0

GQG Partners Global Equity Fund - Z Class International Equities 8.0

Martin Currie Emerging Markets Fund - Class M International Equities 8.0

T.Rowe Price Global Equity - M Class International Equities 8.0

Warakirri Concentrated Australian Equities Fund - Class M Australian Equities 8.0

Bell Global Emerging Companies Fund - Class B International Equities 7.0

Chester High Conviction Fund - Class B Units Australian Equities 7.0

Resolution Capital Global Property Securities Fund - Class C Property 7.0

ATLAS Infrastructure Australian Feeder Fund Class D - Hedged International Equities 6.0

Flinders Emerging Companies Fund - Class A Australian Equities 6.0

Yarra Emerging Leaders Fund - Class A Australian Equities 6.0

Ardea Real Outcome Fund - Class P Australian Fixed Interest 4.0

Legg Mason Brandywine Global Income Optimiser Fund Class B International Fixed Interest 4.0

Legg Mason Western Asset Australian Bond Fund - Class M Australian Fixed Interest 4.0

Western Asset Global Bond Fund - Class M International Fixed Interest 3.0

Yarra Enhanced Income Fund - Class B Australian Fixed Interest 3.0

Cash Account Cash 2.0

Quarterly manager commentary

Market Update

“Nothing to see here” was the first thing that came to mind in the September quarter given how exceptionally strong returns were. But that couldn’t be

further from the truth given how action-packed the period was with bursts of heightened market volatility, a perplexing mix of economic data, and

rising political and geopolitical risks.

Interestingly, the strongest returns came from yield sensitive growth markets like listed property and infrastructure, and Australian equities which were

also assisted by a rising Australian dollar. These asset classes benefited from a combination of central bank rate cuts (abroad) and declining bond

yields all whilst inflationary trends remained somewhat stubborn in certain jurisdictions (namely, Australia and the US).

Relatively strong returns from bonds in the quarter, benefiting firstly from concerns regarding the economic outlook, and then from central bank rate

cuts, both of which put downward pressure on bond yields and hence an uplift in capital values (growth). Corporate credit also performed well with

strong buying from investors and healthy yield levels. Within equity markets, we saw a surprising change in leadership with Chinese equities rocketing

higher on much needed and eagerly awaited Chinese government and central bank stimulus.

Other market moves largely added confusion to the mix. The Australian dollar rose strongly against the USD, largely driven by the latter falling on

concerns regarding the US economic outlook and the outsized initial rate cut from the Fed. Oil prices fell sharply in the period, seemingly appear to

better price recession risks than both equity and bond markets haven been. Even a widening of the conflict in the Middle East wasn’t enough to arrest

the decline in oil price. Increasingly noticed and watched gold prices rose in the quarter, likely pricing in concerns regarding potentially stickier inflation

and a weaker economic and hence lower bond yield environment.

All this played out in a backdrop where the economic picture and outlook became increasingly obfuscated, with different asset classes pricing in or

exhibiting different economic expectations. A couple of sharp and sudden changes in expectations in the quarter saw some rather large single day