Page 3 - Private Wealth Specialist Income Balanced PDF Factsheet

P. 3

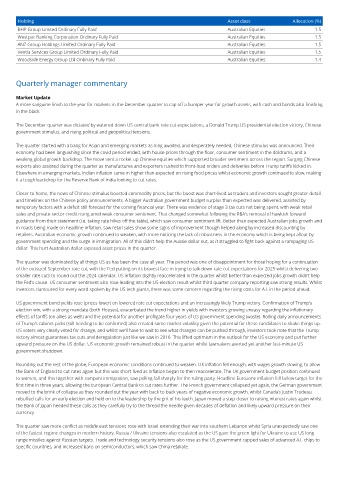

Holding Asset class Allocation (%)

BHP Group Limited Ordinary Fully Paid Australian Equities 1.5

Westpac Banking Corporation Ordinary Fully Paid Australian Equities 1.5

ANZ Group Holdings Limited Ordinary Fully Paid Australian Equities 1.5

Ventia Services Group Limited Ordinary Fully Paid Australian Equities 1.5

Woodside Energy Group Ltd Ordinary Fully Paid Australian Equities 1.4

Quarterly manager commentary

Market Update

A more sanguine finish to the year for markets in the December quarter to cap off a bumper year for growth assets, with cash and bonds also finishing

in the black.

The December quarter was dictated by watered down US central bank rate cut expectations, a Donald Trump US presidential election victory, Chinese

government stimulus, and rising political and geopolitical tensions.

The quarter started with a bang for Asian and emerging markets as long awaited, and desperately needed, Chinese stimulus was announced. Their

economy had been languishing since the covid period ended, with house prices through the floor, consumer sentiment in the doldrums, and a

weaking global growth backdrop. The move sent a rocket up Chinese equities which supported broader sentiment across the region. Surging Chinese

exports also assisted during the quarter as manufactures and exporters rushed to front-load orders and deliveries before Trump tariffs kicked in.

Elsewhere in emerging markets, Indian inflation came in higher than expected on rising food prices whilst economic growth continued to slow, making

it a tough backdrop for the Reserve Bank of India looking to cut rates.

Closer to home, the news of Chinese stimulus boosted commodity prices, but the boost was short-lived as traders and investors sought greater detail

and timelines on the Chinese policy announcements. A bigger Australian government budget surplus than expected was delivered, assisted by

temporary factors with a deficit still forecast for the coming financial year. There was evidence of stage 3 tax cuts not being spent, with weak retail

sales and private sector credit rising amid weak consumer sentiment. That changed somewhat following the RBA’s removal of hawkish forward

guidance from their statement (i.e. taking rate hikes off the table), which saw consumer sentiment lift. Better than expected Australian jobs growth and

in-roads being made on headline inflation, saw retail sales show some signs of improvement though helped along by increased discounting by

retailers. Australian economic growth continued to weaken, with more noticing the lack of robustness in the economy which is being kept afloat by

government spending and the surge in immigration. All of this didn’t help the Aussie dollar out, as it struggled to fight back against a rampaging US

dollar. This hurt Australian dollar exposed asset prices in the quarter.

The quarter was dominated by all things US as has been the case all year. The period was one of disappointment for those hoping for a continuation

of the outsized September rate cut, with the Fed putting on its bravest face in trying to talk down rate cut expectations for 2025 whilst delivering two

smaller rate cuts to round out the 2024 calendar. US inflation slightly reaccelerated in the quarter whilst better than expected jobs growth didn’t help

the Fed’s cause. US consumer sentiment also rose leading into the US election result whilst third quarter company reporting saw strong results. Whilst

investors clamoured for every word spoken by the US tech giants, there was some concern regarding the rising costs for A.I. in the period ahead.

US government bond yields rose (prices lower) on lowered rate cut expectations and an increasingly likely Trump victory. Confirmation of Trump’s

election win, with a strong mandate (both Houses), exacerbated the trend higher in yields with investors growing uneasy regarding the inflationary

effects of tariffs (on allies as well!) and the potential for another profligate four years of US government spending (waste). Rolling daily announcements

of Trump’s cabinet picks (still needing to be confirmed) also created some market volatility given the potential for these candidates to shake things up.

US voters very clearly voted for change, and whilst we’ll have to wait to see what changes can be pushed through, investors took note that the Trump

victory almost guarantees tax cuts and deregulation just like we saw in 2016. This lifted optimism in the outlook for the US economy and put further

upward pressure on the US dollar. US economic growth remained robust in the quarter whilst lawmakers averted yet another last-minute US

government shutdown.

Rounding out the rest of the globe, European economic conditions continued to weaken. UK inflation fell enough, with wages growth slowing, to allow

the Bank of England to cut rates again but this was short-lived as inflation began to then reaccelerate. The UK government budget position continued

to worsen, and this together with rampant immigration, saw polling fall sharply for the ruling party. Headline Eurozone inflation fell below target for the

first time in three years, allowing the European Central Bank to cut rates further. The French government collapsed yet again, the German government

moved to the brink of collapse as they rounded out the year with back-to-back years of negative economic growth, whilst Canada’s Justin Trudeau

rebuffed calls for an early election and held on to the leadership by the grit of his teeth. Japan moved a step closer to raising interest rates again whilst

the Bank of Japan heeded these calls as they carefully try to the thread the needle given decades of deflation and likely upward pressure on their

currency.

The quarter saw more conflict as middle east tensions rose with Israel extending their war into southern Lebanon whilst Syria unexpectedly saw one

of the fastest regime changes in modern history. Russia / Ukraine tensions also escalated as the US gave the green light for Ukraine to use US long

range missiles against Russian targets. Trade and technology security tensions also rose as the US government capped sales of advanced A.I. chips to

specific countries, and increased bans on semiconductors, which saw China retaliate.