Page 2 - Private Wealth Specialist Growth Moderate

P. 2

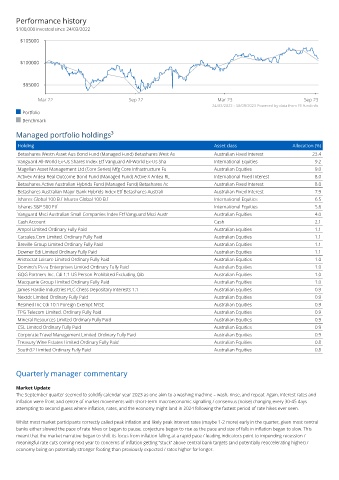

Performance history

$100,000 invested since 24/03/2022

$105000

$100000

$95000

Mar 22 Sep 22 Mar 23 Sep 23

24/03/2022 - 30/09/2023 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

Betashares Westn Asset Aus Bond Fund (Managed Fund) Betashares West As Australian Fixed Interest 23.4

Vanguard All-World Ex-Us Shares Index Etf Vanguard All-World Ex-Us Sha International Equities 9.2

Magellan Asset Management Ltd (Core Series) Mfg Core Infrastructure Fu Australian Equities 9.0

Activex Ardea Real Outcome Bond Fund (Managed Fund) Active X Ardea RL International Fixed Interest 8.0

Betashares Active Australian Hybrids Fund (Managed Fund) Betashares Ac Australian Fixed Interest 8.0

Betashares Australian Major Bank Hybrids Index Etf Betashares Australi Australian Fixed Interest 7.9

Ishares Global 100 Etf Ishares Global 100 Etf International Equities 6.5

Ishares S&P 500 Etf International Equities 5.6

Vanguard Msci Australian Small Companies Index Etf Vanguard Msci Austr Australian Equities 4.0

Cash Account Cash 2.1

Ampol Limited Ordinary Fully Paid Australian Equities 1.1

Carsales.Com Limited. Ordinary Fully Paid Australian Equities 1.1

Breville Group Limited Ordinary Fully Paid Australian Equities 1.1

Downer Edi Limited Ordinary Fully Paid Australian Equities 1.1

Aristocrat Leisure Limited Ordinary Fully Paid Australian Equities 1.0

Domino's Pizza Enterprises Limited Ordinary Fully Paid Australian Equities 1.0

GQG Partners Inc. Cdi 1:1 US Person Prohibited Excluding Qib Australian Equities 1.0

Macquarie Group Limited Ordinary Fully Paid Australian Equities 1.0

James Hardie Industries PLC Chess Depositary Interests 1:1 Australian Equities 0.9

Nextdc Limited Ordinary Fully Paid Australian Equities 0.9

Resmed Inc Cdi 10:1 Foreign Exempt NYSE Australian Equities 0.9

TPG Telecom Limited. Ordinary Fully Paid Australian Equities 0.9

Mineral Resources Limited Ordinary Fully Paid Australian Equities 0.9

CSL Limited Ordinary Fully Paid Australian Equities 0.9

Corporate Travel Management Limited Ordinary Fully Paid Australian Equities 0.9

Treasury Wine Estates Limited Ordinary Fully Paid Australian Equities 0.8

South32 Limited Ordinary Fully Paid Australian Equities 0.8

Quarterly manager commentary

Market Update

The September quarter seemed to solidify calendar year 2023 as one akin to a washing machine – wash, rinse, and repeat. Again, interest rates and

inflation were front and centre of market movements with short-term macroeconomic signalling / consensus (noise) changing every 30-45 days

attempting to second guess where inflation, rates, and the economy might land in 2024 following the fastest period of rate hikes ever seen.

Whilst most market participants correctly called peak inflation and likely peak interest rates (maybe 1-2 more) early in the quarter, given most central

banks either slowed the pace of rate hikes or began to pause, conjecture began to rise as the pace and size of falls in inflation began to slow. This

meant that the market narrative began to shift its focus from inflation falling at a rapid pace / leading indicators point to impending recession /

meaningful rate cuts coming next year to concerns of inflation getting “stuck” above central bank targets (and potentially reaccelerating higher) /

economy being on potentially stronger footing than previously expected / rates higher for longer.