Page 2 - SMA_Portfolio_Best of Breed Moderate_18.11.22

P. 2

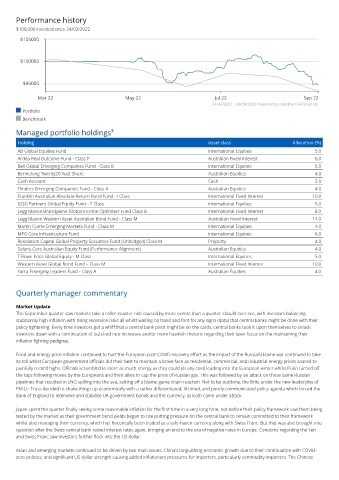

Performance history

$100,000 invested since 24/03/2022

$105000

$100000

$95000

Mar 22 May 22 Jul 22 Sep 22

24/03/2022 - 30/09/2022 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

AB Global Equities Fund International Equities 5.0

Ardea Real Outcome Fund - Class P Australian Fixed Interest 6.0

Bell Global Emerging Companies Fund - Class B International Equities 5.0

Bennelong Twenty20 Aust Share Australian Equities 4.0

Cash Account Cash 2.0

Flinders Emerging Companies Fund - Class A Australian Equities 4.0

Franklin Australian Absolute Return Bond Fund - I Class International Fixed Interest 10.0

GQG Partners Global Equity Fund - Z Class International Equities 5.0

Legg Mason Brandywine Global Income Optimiser Fund Class B International Fixed Interest 8.0

Legg Mason Western Asset Australian Bond Fund - Class M Australian Fixed Interest 14.0

Martin Currie Emerging Markets Fund - Class M International Equities 4.0

MFG Core Infrastructure Fund International Equities 6.0

Resolution Capital Global Property Securities Fund (Unhedged) Class M Property 4.0

Solaris Core Australian Equity Fund (Performance Alignment) Australian Equities 4.0

T.Rowe Price Global Equity - M Class International Equities 5.0

Western Asset Global Bond Fund – Class M International Fixed Interest 10.0

Yarra Emerging Leaders Fund - Class A Australian Equities 4.0

Quarterly manager commentary

Market Update

The September quarter saw markets take a roller-coaster ride caused by more events than a quarter should ever see, with investors balancing

stubbornly high inflation with rising recession risks all whilst waiting on hand and foot for any signs (data) that central banks might be done with their

policy tightening. Every time investors got a whiff that a central bank pivot might be on the cards, central banks took it upon themselves to smack

investors down with a continuation of outsized rate increases and/or more hawkish rhetoric regarding their laser focus on the maintaining their

inflation fighting pedigree.

Food and energy price inflation continued to hurt the European post-COVID recovery effort as the impact of the Russia/Ukraine war continued to take

its toll whilst European government officials did their best to maintain a brave face as residential, commercial, and industrial energy prices soared to

painfully record highs. Officials scrambled to store as much energy as they could (at any cost) leading into the European winter whilst Putin turned off

the taps following moves by the Europeans and their allies to cap the price of Russian gas. This was followed by an attack on those same Russian

pipelines that resulted in LNG spilling into the sea, setting off a blame-game chain reaction. Not to be outdone, the Brits under the new leadership of

PM Liz Truss decided to shake things up economically with a rather differentiated, ill-timed, and poorly communicated policy agenda which forced the

Bank of England to intervene and stabilise UK government bonds and the currency, as both came under attack.

Japan spent the quarter finally seeing some reasonable inflation for the first time in a very long time, not before their policy framework saw them being

tested by the market as their government bond yields began to rise putting pressure on the central bank to remain committed to their framework

whilst also managing their currency, which has historically been traded as a safe-haven currency along with Swiss Franc. But that was also brought into

question after the Swiss central bank raised interest rates again, bringing an end to the era of negative rates in Europe. Concerns regarding the Yen

and Swiss Franc saw investors further flock into the US dollar.

Asian and emerging markets continued to be driven by two main issues: China’s languishing economic growth due to their continuation with COVID-

zero policies; and significant US dollar strength causing added inflationary pressures for importers, particularly commodity importers. The Chinese