Page 2 - Private Wealth Specialist Growth Moderate

P. 2

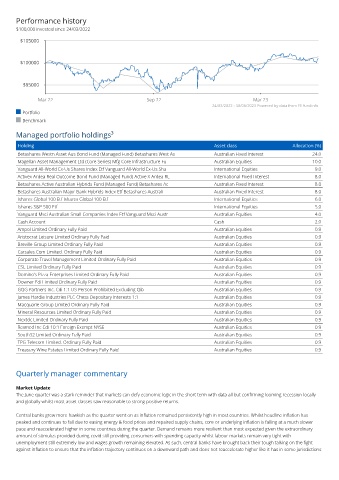

Performance history

$100,000 invested since 24/03/2022

$105000

$100000

$95000

Mar 22 Sep 22 Mar 23

24/03/2022 - 30/06/2023 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

Betashares Westn Asset Aus Bond Fund (Managed Fund) Betashares West As Australian Fixed Interest 24.0

Magellan Asset Management Ltd (Core Series) Mfg Core Infrastructure Fu Australian Equities 10.0

Vanguard All-World Ex-Us Shares Index Etf Vanguard All-World Ex-Us Sha International Equities 9.0

Activex Ardea Real Outcome Bond Fund (Managed Fund) Active X Ardea RL International Fixed Interest 8.0

Betashares Active Australian Hybrids Fund (Managed Fund) Betashares Ac Australian Fixed Interest 8.0

Betashares Australian Major Bank Hybrids Index Etf Betashares Australi Australian Fixed Interest 8.0

Ishares Global 100 Etf Ishares Global 100 Etf International Equities 6.0

Ishares S&P 500 Etf International Equities 5.0

Vanguard Msci Australian Small Companies Index Etf Vanguard Msci Austr Australian Equities 4.0

Cash Account Cash 2.0

Ampol Limited Ordinary Fully Paid Australian Equities 0.9

Aristocrat Leisure Limited Ordinary Fully Paid Australian Equities 0.9

Breville Group Limited Ordinary Fully Paid Australian Equities 0.9

Carsales.Com Limited. Ordinary Fully Paid Australian Equities 0.9

Corporate Travel Management Limited Ordinary Fully Paid Australian Equities 0.9

CSL Limited Ordinary Fully Paid Australian Equities 0.9

Domino's Pizza Enterprises Limited Ordinary Fully Paid Australian Equities 0.9

Downer Edi Limited Ordinary Fully Paid Australian Equities 0.9

GQG Partners Inc. Cdi 1:1 US Person Prohibited Excluding Qib Australian Equities 0.9

James Hardie Industries PLC Chess Depositary Interests 1:1 Australian Equities 0.9

Macquarie Group Limited Ordinary Fully Paid Australian Equities 0.9

Mineral Resources Limited Ordinary Fully Paid Australian Equities 0.9

Nextdc Limited Ordinary Fully Paid Australian Equities 0.9

Resmed Inc Cdi 10:1 Foreign Exempt NYSE Australian Equities 0.9

South32 Limited Ordinary Fully Paid Australian Equities 0.9

TPG Telecom Limited. Ordinary Fully Paid Australian Equities 0.9

Treasury Wine Estates Limited Ordinary Fully Paid Australian Equities 0.9

Quarterly manager commentary

Market Update

The June quarter was a stark reminder that markets can defy economic logic in the short term with data all but confirming looming recession locally

and globally whilst most asset classes saw reasonable to strong positive returns.

Central banks grew more hawkish as the quarter went on as inflation remained persistently high in most countries. Whilst headline inflation has

peaked and continues to fall due to easing energy & food prices and repaired supply chains, core or underlying inflation is falling at a much slower

pace and reaccelerated higher in some countries during the quarter. Demand remains more resilient than most expected given the extraordinary

amount of stimulus provided during covid still providing consumers with spending capacity whilst labour markets remain very tight with

unemployment still extremely low and wages growth remaining elevated. As such, central banks have brought back their tough talking on the fight

against inflation to ensure that the inflation trajectory continues on a downward path and does not reaccelerate higher like it has in some jurisdictions.