Page 2 - Private Wealth Core Moderate PDF Factsheet

P. 2

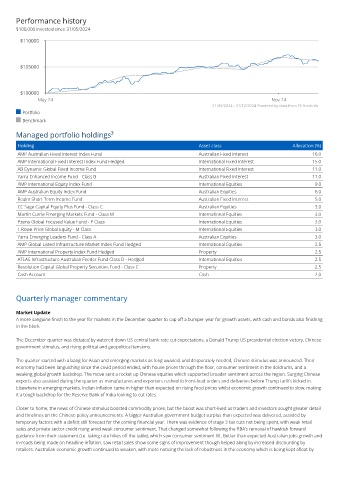

Performance history

$100,000 invested since 31/05/2024

$110000

$105000

$100000

May 24 Nov 24

31/05/2024 - 31/12/2024 Powered by data from FE fundinfo

Portfolio

Benchmark

Managed portfolio holdings³

Holding Asset class Allocation (%)

AMP Australian Fixed Interest Index Fund Australian Fixed Interest 16.0

AMP International Fixed Interest Index Fund Hedged International Fixed Interest 15.0

AB Dynamic Global Fixed Income Fund International Fixed Interest 11.0

Yarra Enhanced Income Fund - Class B Australian Fixed Interest 11.0

AMP International Equity Index Fund International Equities 9.0

AMP Australian Equity Index Fund Australian Equities 6.0

Realm Short Term Income Fund Australian Fixed Interest 5.0

CC Sage Capital Equity Plus Fund - Class C Australian Equities 3.0

Martin Currie Emerging Markets Fund - Class M International Equities 3.0

Pzena Global Focused Value Fund - P Class International Equities 3.0

T.Rowe Price Global Equity - M Class International Equities 3.0

Yarra Emerging Leaders Fund - Class A Australian Equities 3.0

AMP Global Listed Infrastructure Market Index Fund Hedged International Equities 2.5

AMP International Property Index Fund Hedged Property 2.5

ATLAS Infrastructure Australian Feeder Fund Class D - Hedged International Equities 2.5

Resolution Capital Global Property Securities Fund - Class C Property 2.5

Cash Account Cash 2.0

Quarterly manager commentary

Market Update

A more sanguine finish to the year for markets in the December quarter to cap off a bumper year for growth assets, with cash and bonds also finishing

in the black.

The December quarter was dictated by watered down US central bank rate cut expectations, a Donald Trump US presidential election victory, Chinese

government stimulus, and rising political and geopolitical tensions.

The quarter started with a bang for Asian and emerging markets as long awaited, and desperately needed, Chinese stimulus was announced. Their

economy had been languishing since the covid period ended, with house prices through the floor, consumer sentiment in the doldrums, and a

weaking global growth backdrop. The move sent a rocket up Chinese equities which supported broader sentiment across the region. Surging Chinese

exports also assisted during the quarter as manufactures and exporters rushed to front-load orders and deliveries before Trump tariffs kicked in.

Elsewhere in emerging markets, Indian inflation came in higher than expected on rising food prices whilst economic growth continued to slow, making

it a tough backdrop for the Reserve Bank of India looking to cut rates.

Closer to home, the news of Chinese stimulus boosted commodity prices, but the boost was short-lived as traders and investors sought greater detail

and timelines on the Chinese policy announcements. A bigger Australian government budget surplus than expected was delivered, assisted by

temporary factors with a deficit still forecast for the coming financial year. There was evidence of stage 3 tax cuts not being spent, with weak retail

sales and private sector credit rising amid weak consumer sentiment. That changed somewhat following the RBA’s removal of hawkish forward

guidance from their statement (i.e. taking rate hikes off the table), which saw consumer sentiment lift. Better than expected Australian jobs growth and

in-roads being made on headline inflation, saw retail sales show some signs of improvement though helped along by increased discounting by

retailers. Australian economic growth continued to weaken, with more noticing the lack of robustness in the economy which is being kept afloat by