Page 52 - Report Final MMIX 31 Des 2022

P. 52

These financial statements are originally issued in Indonesian language.

- 41 -

PT MULTI MEDIKA INTERNASIONAL Tbk PT MULTI MEDIKA INTERNASIONAL Tbk

CATATAN ATAS LAPORAN KEUANGAN (Lanjutan) NOTES TO THE FINANCIAL STATEMENTS (Continued)

UNTUK 31 DESEMBER 2022 DAN 2021 DECEMBER 31, 2022 AND 2021

(Disajikan dalam Rupiah, kecuali dinyatakan lain) (Expressed in Rupiah, unless otherwise stated)

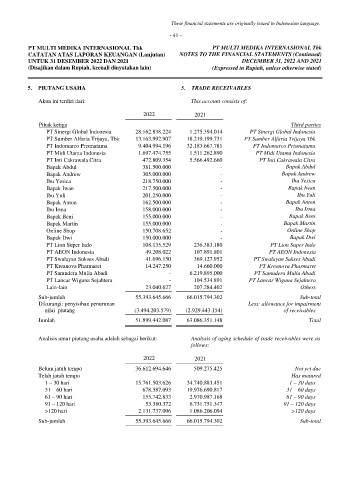

5. PIUTANG USAHA 5. TRADE RECEIVABLES

Akun ini terdiri dari: This account consists of:

2022 2021

Pihak ketiga Third parties

PT Sinergi Global Indonesia 28.162.838.224 1.275.394.014 PT Sinergi Global Indonesia

PT Sumber Alfaria Trijaya, Tbk 13.163.992.907 18.219.199.731 PT Sumber Alfaria Trijaya Tbk

PT Indomarco Prismatama 9.404.994.196 32.183.667.781 PT Indomarco Prismatama

PT Midi Utama Indonesia 1.697.474.755 1.511.262.890 PT Midi Utama Indonesia

PT Inti Cakrawala Citra 472.809.354 5.566.492.660 PT Inti Cakrawala Citra

Bapak Abdul 381.500.000 - Bapak Abdul

Bapak Andrew 305.000.000 - Bapak Andrew

Ibu Yesica 218.750.000 - Ibu Yesica

Bapak Iwan 217.500.000 - Bapak Iwan

Ibu Yuli 201.250.000 - Ibu Yuli

Bapak Anton 162.500.000 - Bapak Anton

Ibu Irma 158.000.000 - Ibu Irma

Bapak Beni 155.000.000 - Bapak Beni

Bapak Martin 155.000.000 - Bapak Martin

Online Shop 150.708.652 - Online Shop

Bapak Dwi 150.000.000 - Bapak Dwi

PT Lion Super Indo 108.135.529 236.383.180 PT Lion Super Indo

PT AEON Indonesia 49.208.022 107.891.801 PT AEON Indonesia

PT Swalayan Sukses Abadi 41.696.150 369.127.952 PT Swalayan Sukses Abadi

PT Kreanova Pharmaret 14.247.250 14.660.000 PT Kreanova Pharmaret

PT Samudera Mulia Abadi - 6.219.895.000 PT Samudera Mulia Abadi

PT Lancar Wiguna Sejahtera - 104.534.891 PT Lancar Wiguna Sejahtera

Lain-lain 23.040.627 207.284.402 Others

Sub-jumlah 55.393.645.666 66.015.794.302 Sub-total

Dikurangi: penyisihan penurunan Less: allowance for impairment

nilai piutang (3.494.203.579) (2.929.443.154) of receivables

Jumlah 51.899.442.087 63.086.351.148 Total

Analisis umur piutang usaha adalah sebagai berikut: Analysis of aging schedule of trade receivables were as

follows:

2022 2021

Belum jatuh tempo 36.612.694.646 509.275.425 Not yet due

Telah jatuh tempo Has matured

1 – 30 hari 15.761.503.626 34.740.883.451 1 – 30 days

31 – 60 hari 678.587.093 19.976.690.817 31 – 60 days

61 – 90 hari 155.742.833 2.970.987.168 61 – 90 days

91 – 120 hari 53.380.372 6.731.751.347 91 – 120 days

>120 hari 2.131.737.096 1.086.206.094 >120 days

Sub-jumlah 55.393.645.666 66.015.794.302 Sub-total