Page 78 - ITI VC Guide V10

P. 78

78

Equity Funding Guide

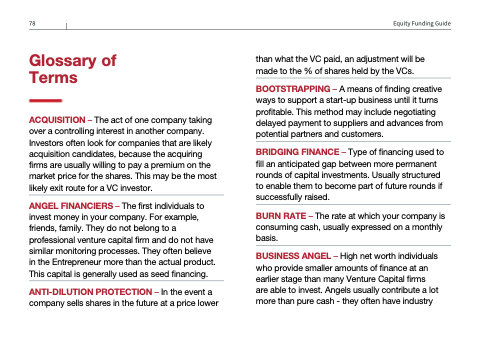

Glossary of Terms

ACQUISITION – The act of one company taking over a controlling interest in another company. Investors often look for companies that are likely acquisition candidates, because the acquiring firms are usually willing to pay a premium on the market price for the shares. This may be the most likely exit route for a VC investor.

ANGEL FINANCIERS – The first individuals to invest money in your company. For example, friends, family. They do not belong to a professional venture capital firm and do not have similar monitoring processes. They often believe in the Entrepreneur more than the actual product. This capital is generally used as seed financing.

ANTI-DILUTION PROTECTION – In the event a company sells shares in the future at a price lower

than what the VC paid, an adjustment will be made to the % of shares held by the VCs.

BOOTSTRAPPING – A means of finding creative ways to support a start-up business until it turns profitable. This method may include negotiating delayed payment to suppliers and advances from potential partners and customers.

BRIDGING FINANCE – Type of financing used to fill an anticipated gap between more permanent rounds of capital investments. Usually structured to enable them to become part of future rounds if successfully raised.

BURN RATE – The rate at which your company is consuming cash, usually expressed on a monthly basis.

BUSINESS ANGEL – High net worth individuals who provide smaller amounts of finance at an earlier stage than many Venture Capital firms are able to invest. Angels usually contribute a lot more than pure cash - they often have industry