Page 80 - ITI VC Guide V10

P. 80

80

Equity Funding Guide

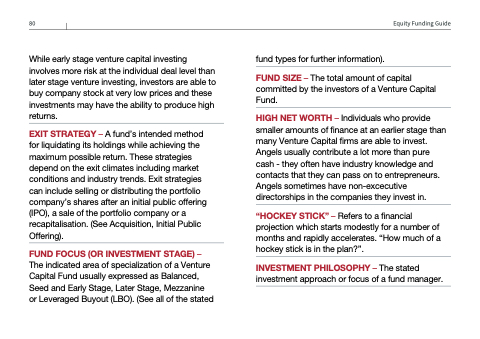

While early stage venture capital investing involves more risk at the individual deal level than later stage venture investing, investors are able to buy company stock at very low prices and these investments may have the ability to produce high returns.

EXIT STRATEGY – A fund’s intended method for liquidating its holdings while achieving the maximum possible return. These strategies depend on the exit climates including market conditions and industry trends. Exit strategies can include selling or distributing the portfolio company’s shares after an initial public offering (IPO), a sale of the portfolio company or a recapitalisation. (See Acquisition, Initial Public Offering).

FUND FOCUS (OR INVESTMENT STAGE) – The indicated area of specialization of a Venture Capital Fund usually expressed as Balanced, Seed and Early Stage, Later Stage, Mezzanine or Leveraged Buyout (LBO). (See all of the stated

fund types for further information).

FUND SIZE – The total amount of capital committed by the investors of a Venture Capital Fund.

HIGH NET WORTH – Individuals who provide smaller amounts of finance at an earlier stage than many Venture Capital firms are able to invest. Angels usually contribute a lot more than pure cash - they often have industry knowledge and contacts that they can pass on to entrepreneurs. Angels sometimes have non-excecutive directorships in the companies they invest in.

“HOCKEY STICK” – Refers to a financial projection which starts modestly for a number of months and rapidly accelerates. “How much of a hockey stick is in the plan?”.

INVESTMENT PHILOSOPHY – The stated investment approach or focus of a fund manager.