Page 57 - MAZOO EBOOK 1_Neat

P. 57

Taxable Profit will be ($500 – Depreciation as per tax ($1000*20% = $200)) i.e. $300

Current Tax will be payable on $300 *Tax Rate.

Deferred Tax will arise on temporary difference, i.e., the difference between depreciation as per

accounting and depreciation as per tax. In the above example, the deferred tax will arise at

$100.

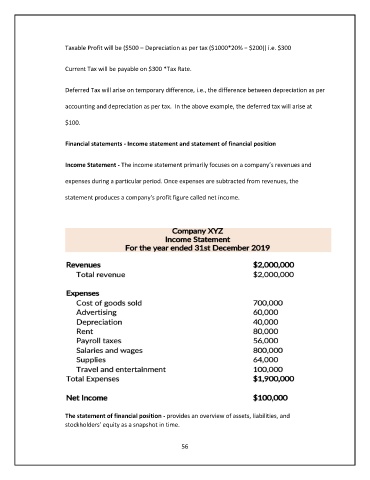

Financial statements - Income statement and statement of financial position

Income Statement - The income statement primarily focuses on a company’s revenues and

expenses during a particular period. Once expenses are subtracted from revenues, the

statement produces a company's profit figure called net income.

The statement of financial position - provides an overview of assets, liabilities, and

stockholders' equity as a snapshot in time.

56