Page 13 - BALANCE SHEET MGT_001(1)

P. 13

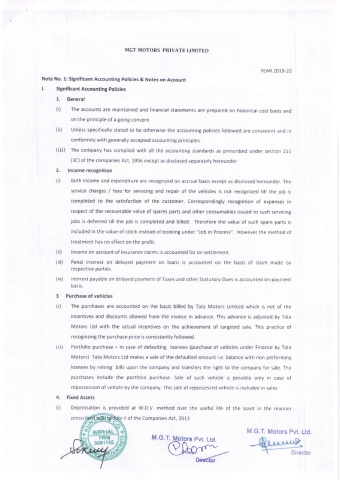

MGT MOTORS PRIVATT: I.IMITED

YEAR 2019-20

Note No. 1: Significant Accountlng Pollcies & Notes on Account

l. Signiflcant Accounting pollcies

1. General

(i) The accounts are maintained and financial statements are prepared on historical cost basis and

on the principle of a going concern

(ii) Unless specifically stated to be otherwise the accounting policies followed are consistent and in

conformity with generally accepted accounting principles.

(iii) The company has complied with all the accounting standards as prescribed under section 211

(3C) of the companies Act, 1956 except as disclosed separately hereunder

2. Income recognition

(i) Both income and expenditure are recognized on accrual basis except as disclosed hereunder. The

service charges / fees for servicing and repair of the vehicles is not recognized till the ,ob is

completed to the satisfaction of the customer. Correspondingly recognition of expenses in

respect of the recoverable value of spares parts and other consumables issued to such servicing

jobs is deferred till the job is completed and billed. Therefore the value of such spare parts is

included in the value of stock instead of booking under "Job in Process". However the method of

treatment has no effect on the profit.

(ii) lncome on account of insurance claims is accounted for on settlement.

(iii) Penal interest on delayed payment on loans is accounted on the basis of claim made by

respective parties.

(iv) lnterest payable on delayed payment of faxes and other Statutory Dues is accounted on payment

basis.

3 Purchase of vehicles

(i) The purchases are accounted on the basis billed by Tata Motors Limited which is net of the

incentives and discounts allowed from the invoice in advance. This advance is adjusted by Tata

Motors Ltd with the actual incentives on the achievement of targeted sale. This practice of

recognizing the purchase price is consistently followed.

(ii) Portfolio purchase - ln case of defaulting loanees (purchase of vehicles under Finance by Tata

Motors) Tata Motors Ltd makes a sale of the defaulted amount i.e. balance with non performing

loanees by raising bills upon the company and transfers the right to the company for sale. The

purchases include the portfolio purchase. Sale of such vehicle is possible only in case of

repossession of vehicle by the company. Ihis sale of repossessed vehrcle is included rn sales

4. Fixed Assets

(i) Depreciation is provided at W.D.V. method over the useful life of the asset in the manner

' Ji',li ll of the Companies Act, 2013

M.G.T. Motors P\d. Ltd.

M,G.T. Pvt. Ltd

30911 4Fl*p**