Page 101 - مطالعه سرمایه گذاری در کشور موریس-07

P. 101

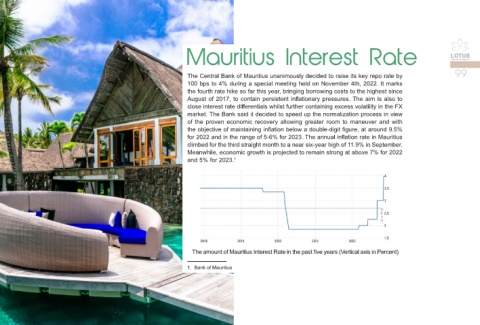

Mauritius Interest Rate

The Central Bank of Mauritius unanimously decided to raise its key repo rate by 99

100 bps to 4% during a special meeting held on November 4th, 2022. It marks

the fourth rate hike so far this year, bringing borrowing costs to the highest since

August of 2017, to contain persistent inflationary pressures. The aim is also to

close interest rate differentials whilst further containing excess volatility in the FX

market. The Bank said it decided to speed up the normalization process in view

of the proven economic recovery allowing greater room to maneuver and with

the objective of maintaining inflation below a double-digit figure, at around 9.5%

for 2022 and in the range of 5-6% for 2023. The annual inflation rate in Mauritius

climbed for the third straight month to a near six-year high of 11.9% in September.

Meanwhile, economic growth is projected to remain strong at above 7% for 2022

and 5% for 2023.

1

The amount of Mauritius Interest Rate in the past five years (Vertical axis in Percent)

1. Bank of Mauritius