Page 25 - Cover Letter and Evaluation for Michael Boucher

P. 25

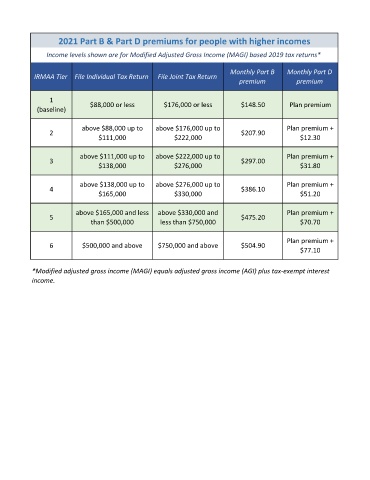

2021 Part B & Part D premiums for people with higher incomes

Income levels shown are for Modified Adjusted Gross Income (MAGI) based 2019 tax returns*

Monthly Part B Monthly Part D

IRMAA Tier File Individual Tax Return File Joint Tax Return

premium premium

1 $88,000 or less $176,000 or less $148.50 Plan premium

(baseline)

above $88,000 up to above $176,000 up to Plan premium +

2 $207.90

$111,000 $222,000 $12.30

above $111,000 up to above $222,000 up to Plan premium +

3 $297.00

$138,000 $276,000 $31.80

above $138,000 up to above $276,000 up to Plan premium +

4 $386.10

$165,000 $330,000 $51.20

above $165,000 and less above $330,000 and Plan premium +

5 $475.20

than $500,000 less than $750,000 $70.70

Plan premium +

6 $500,000 and above $750,000 and above $504.90

$77.10

*Modified adjusted gross income (MAGI) equals adjusted gross income (AGI) plus tax-exempt interest

income.