Page 15 - Cover Letter and Medicare Evaluation for Eric Hartman

P. 15

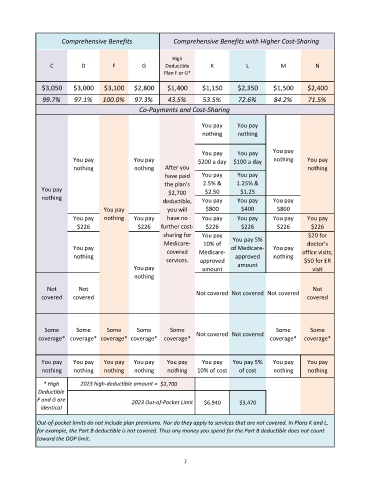

Comprehensive Benefits Comprehensive Benefits with Higher Cost-Sharing

High

C D F G Deductible K L M N

Plan F or G*

$3,050 $3,000 $3,100 $2,800 $1,400 $1,150 $2,350 $1,500 $2,400

99.7% 97.1% 100.0% 97.3% 43.5% 53.5% 72.6% 84.2% 71.5%

Co-Payments and Cost-Sharing

You pay You pay

nothing nothing

You pay You pay You pay

You pay You pay $200 a day $100 a day nothing You pay

nothing nothing After you nothing

have paid You pay You pay

the plan's 2.5% & 1.25% &

You pay $2,700 $2.50 $1.25

nothing

deductible, You pay You pay You pay

You pay you will $800 $400 $800

You pay nothing You pay have no You pay You pay You pay You pay

$226 $226 further cost- $226 $226 $226 $226

sharing for You pay $20 for

Medicare- 10% of You pay 5% doctor's

You pay covered Medicare- of Medicare- You pay office visits;

nothing approved nothing

services. approved $50 for ER

You pay amount amount visit

nothing

Not Not Not covered Not covered Not covered Not

covered covered covered

Some Some Some Some Some Some Some

coverage* coverage* coverage* coverage* coverage* Not covered Not covered coverage* coverage*

You pay You pay You pay You pay You pay You pay You pay 5% You pay You pay

nothing nothing nothing nothing nothing 10% of cost of cost nothing nothing

* High 2023 high-deductible amount = $2,700

Deductible

F and G are 2023 Out-of-Pocket Limit $6,940 $3,470

identical

Out-of-pocket limits do not include plan premiums. Nor do they apply to services that are not covered. In Plans K and L,

for example, the Part B deductible is not covered. Thus any money you spend for the Part B deductible does not count

toward the OOP limit.

7