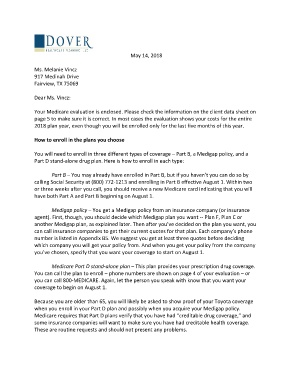

Page 1 - Cover Letter and Evaluation for Melanie

P. 1

May 14, 2018

Ms. Melanie Vincz

917 Medinah Drive

Fairview, TX 75069

Dear Ms. Vincz:

Your Medicare evaluation is enclosed. Please check the information on the client data sheet on

page 5 to make sure it is correct. In most cases the evaluation shows your costs for the entire

2018 plan year, even though you will be enrolled only for the last five months of this year.

How to enroll in the plans you choose

You will need to enroll in three different types of coverage – Part B, a Medigap policy, and a

Part D stand-alone drug plan. Here is how to enroll in each type:

Part B – You may already have enrolled in Part B, but if you haven’t you can do so by

calling Social Security at (800) 772-1213 and enrolling in Part B effective August 1. Within two

or three weeks after you call, you should receive a new Medicare card indicating that you will

have both Part A and Part B beginning on August 1.

Medigap policy – You get a Medigap policy from an insurance company (or insurance

agent). First, though, you should decide which Medigap plan you want -- Plan F, Plan C or

another Medigap plan, as explained later. Then after you’ve decided on the plan you want, you

can call insurance companies to get their current quotes for that plan. Each company’s phone

number is listed in Appendix B5. We suggest you get at least three quotes before deciding

which company you will get your policy from. And when you get your policy from the company

you’ve chosen, specify that you want your coverage to start on August 1.

Medicare Part D stand-alone plan – This plan provides your prescription drug coverage.

You can call the plan to enroll – phone numbers are shown on page 4 of your evaluation – or

you can call 800-MEDICARE. Again, let the person you speak with know that you want your

coverage to begin on August 1.

Because you are older than 65, you will likely be asked to show proof of your Toyota coverage

when you enroll in your Part D plan and possibly when you acquire your Medigap policy.

Medicare requires that Part D plans verify that you have had “creditable drug coverage,” and

some insurance companies will want to make sure you have had creditable health coverage.

These are routine requests and should not present any problems.