Page 176 - Hollard Business Policy - Binder

P. 176

4. if it is required that the driver of the insured vehicle effects a separate third party liability insurance specific to any other country concerned, then the Company will not indemnify the Insured for any legal liability incurred through the use or possession of the insured vehicle whilst in the country concerned outside the borders of South Africa.

SUB-SECTION C – MEDICAL BENEFITS DEFINED EVENTS

If an occupant in the specified part of a vehicle described below, in direct connection with such vehicle, sustains bodily injury by violent, accidental, external and visible means, the Company will pay to the Insured the medical expenses incurred as a result of such injury up to R10 000 (ten thousand rand) per injured occupant and in total for all occupants injured as a result of an occurrence or series of occurrences arising out of one event.

The amount payable under this Sub-Section shall be reduced by any amount recoverable under any workmen's compensation enactment or similar legislation or under any medical expenses scheme or medical insurance.

The term 'medical expenses' includes any costs incurred to free such injured occupant from such vehicle or to bring such injured occupant to a place where medical treatment can be given.

Motor Traders Risk

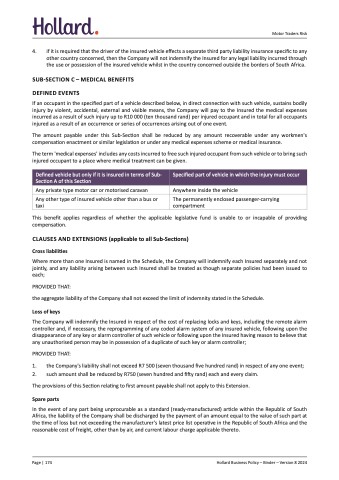

Defined vehicle but only if it is insured in terms of Sub- Section A of this Section

Specified part of vehicle in which the injury must occur

Any private type motor car or motorised caravan

Any other type of insured vehicle other than a bus or taxi

Anywhere inside the vehicle

The permanently enclosed passenger-carrying compartment

This benefit applies regardless of whether the applicable legislative fund is unable to or incapable of providing compensation.

CLAUSES AND EXTENSIONS (applicable to all Sub-Sections) Cross liabilities

Where more than one Insured is named in the Schedule, the Company will indemnify each Insured separately and not jointly, and any liability arising between such Insured shall be treated as though separate policies had been issued to each;

PROVIDED THAT:

the aggregate liability of the Company shall not exceed the limit of indemnity stated in the Schedule.

Loss of keys

The Company will indemnify the Insured in respect of the cost of replacing locks and keys, including the remote alarm controller and, if necessary, the reprogramming of any coded alarm system of any insured vehicle, following upon the disappearance of any key or alarm controller of such vehicle or following upon the Insured having reason to believe that any unauthorised person may be in possession of a duplicate of such key or alarm controller;

PROVIDED THAT:

1. the Company's liability shall not exceed R7 500 (seven thousand five hundred rand) in respect of any one event;

2. such amount shall be reduced by R750 (seven hundred and fifty rand) each and every claim.

The provisions of this Section relating to first amount payable shall not apply to this Extension.

Spare parts

In the event of any part being unprocurable as a standard (ready-manufactured) article within the Republic of South Africa, the liability of the Company shall be discharged by the payment of an amount equal to the value of such part at the time of loss but not exceeding the manufacturer's latest price list operative in the Republic of South Africa and the reasonable cost of freight, other than by air, and current labour charge applicable thereto.

Page | 174 Hollard Business Policy – Binder – Version 8 2024