Page 53 - Commercial - Underwriting Mandates & Guidelines Binder

P. 53

Business Interruption

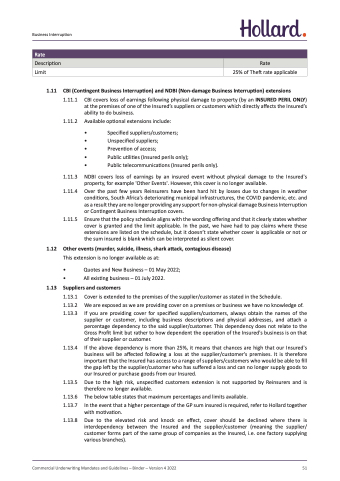

Rate

Description

Rate

Limit

25% of Theft rate applicable

1.11 CBI (Contingent Business Interruption) and NDBI (Non-damage Business Interruption) extensions

1.11.1 CBI covers loss of earnings following physical damage to property (by an INSURED PERIL ONLY) at the premises of one of the Insured’s suppliers or customers which directly affects the Insured’s ability to do business.

1.11.2 Available optional extensions include:

• Specified suppliers/customers;

• Unspecified suppliers;

• Prevention of access;

• Public utilities (Insured perils only);

• Public telecommunications (Insured perils only).

1.11.3 NDBI covers loss of earnings by an insured event without physical damage to the Insured's property, for example 'Other Events'. However, this cover is no longer available.

1.11.4 Over the past few years Reinsurers have been hard hit by losses due to changes in weather conditions, South Africa’s deteriorating municipal infrastructures, the COVID pandemic, etc. and as a result they are no longer providing any support for non-physical damage Business Interruption or Contingent Business Interruption covers.

1.11.5 Ensure that the policy schedule aligns with the wording offering and that it clearly states whether cover is granted and the limit applicable. In the past, we have had to pay claims where these extensions are listed on the schedule, but it doesn’t state whether cover is applicable or not or the sum insured is blank which can be interpreted as silent cover.

1.12 Other events (murder, suicide, illness, shark attack, contagious disease)

This extension is no longer available as at:

• Quotes and New Business – 01 May 2022;

• All existing business – 01 July 2022.

1.13 Suppliers and customers

1.13.1 Cover is extended to the premises of the supplier/customer as stated in the Schedule.

1.13.2 We are exposed as we are providing cover on a premises or business we have no knowledge of.

1.13.3 If you are providing cover for specified suppliers/customers, always obtain the names of the supplier or customer, including business descriptions and physical addresses, and attach a percentage dependency to the said supplier/customer. This dependency does not relate to the Gross Profit limit but rather to how dependent the operation of the Insured's business is on that of their supplier or customer.

1.13.4 If the above dependency is more than 25%, it means that chances are high that our Insured's business will be affected following a loss at the supplier/customer's premises. It is therefore important that the Insured has access to a range of suppliers/customers who would be able to fill the gap left by the supplier/customer who has suffered a loss and can no longer supply goods to our Insured or purchase goods from our Insured.

1.13.5 Due to the high risk, unspecified customers extension is not supported by Reinsurers and is therefore no longer available.

1.13.6 The below table states that maximum percentages and limits available.

1.13.7 In the event that a higher percentage of the GP sum insured is required, refer to Hollard together with motivation.

1.13.8 Due to the elevated risk and knock on effect, cover should be declined where there is interdependency between the Insured and the supplier/customer (meaning the supplier/ customer forms part of the same group of companies as the Insured, i.e. one factory supplying various branches).

Commercial Underwriting Mandates and Guidelines – Binder – Version 4 2022 51