Page 55 - Commercial - Underwriting Mandates & Guidelines Binder

P. 55

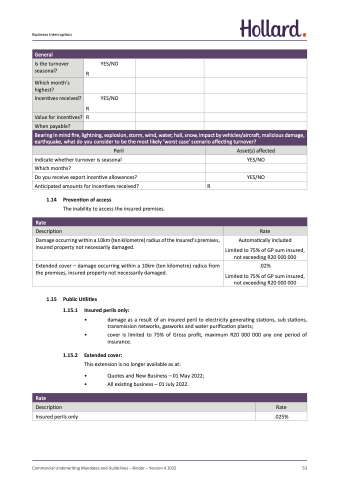

Business Interruption

General

Is the turnover seasonal?

YES/NO R

Which month's highest?

Incentives received?

YES/NO R

Value for incentives?

R

When payable?

Bearing in mind fire, lightning, explosion, storm, wind, water, hail, snow, impact by vehicles/aircraft, malicious damage, earthquake, what do you consider to be the most likely 'worst case' scenario affecting turnover?

Peril

Asset(s) affected

Indicate whether turnover is seasonal

Which months?

Do you receive export incentive allowances?

Anticipated amounts for incentives received?

1.14 Prevention of access

The inability to access the insured premises.

YES/NO

YES/NO

1.15 Public Utilities

1.15.1 Insured perils only:

• damage as a result of an insured peril to electricity generating stations, sub stations, transmission networks, gasworks and water purification plants;

• cover is limited to 75% of Gross profit, maximum R20 000 000 any one period of insurance.

1.15.2 Extended cover:

This extension is no longer available as at:

• Quotes and New Business – 01 May 2022;

• All existing business – 01 July 2022.

R

Rate

Description

Rate

Damage occurring within a 10km (ten kilometre) radius of the Insured's premises, insured property not necessarily damaged.

Automatically included

Limited to 75% of GP sum insured, not exceeding R20 000 000

Extended cover – damage occurring within a 10km (ten kilometre) radius from the premises, insured property not necessarily damaged.

.02%

Limited to 75% of GP sum insured, not exceeding R20 000 000

Rate

Description

Rate

Insured perils only

.025%

Commercial Underwriting Mandates and Guidelines – Binder – Version 4 2022 53