Page 37 - Combined file Solheim

P. 37

APPLICATION FOR ASSISTANCE OF A M KENZIE FRIEND

C

PART 8: DETAILED COMMENTS

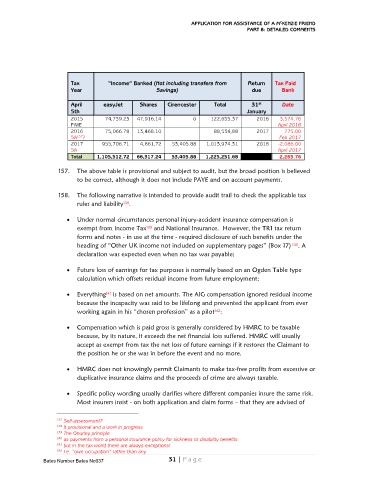

Tax “Income” Banked (Not including transfers from Return Tax Paid

Year Savings) due Bank

April easyJet Shares Cirencester Total 31 Date

st

5th January

2015 74,739.23 47,916.14 0 122,655.37 2016 3,574.76

PAYE April 2016

2016 75,066.78 13,468.10 88,534,88 2017 775.00

SA 137 ? Feb 2017

2017 955,706.71 4,861,72 53,405.88 1,013,974.31 2018 -2,086.00

SA April 2017

Total 1,105,512.72 66,317.24 53,405.88 1,225,251.68 2,263.76

157. The above table is provisional and subject to audit, but the broad position is believed

to be correct, although it does not include PAYE and on account payments.

158. The following narrative is intended to provide audit trail to check the applicable tax

rules and liability .

138

Under normal circumstances personal injury-accident insurance compensation is

exempt from Income Tax and National Insurance. However, the TR1 tax return

139

forms and notes - in use at the time - required disclosure of such benefits under the

heading of “Other UK income not included on supplementary pages” (Box 17) 140 . A

declaration was expected even when no tax was payable;

Future loss of earnings for tax purposes is normally based on an Ogden Table type

calculation which offsets residual income from future employment;

Everything is based on net amounts. The AIG compensation ignored residual income

141

because the incapacity was said to be lifelong and prevented the applicant from ever

working again in his “chosen profession” as a pilot ;

142

Compensation which is paid gross is generally considered by HMRC to be taxable

because, by its nature, it exceeds the net financial loss suffered. HMRC will usually

accept as exempt from tax the net loss of future earnings if it restores the Claimant to

the position he or she was in before the event and no more.

HMRC does not knowingly permit Claimants to make tax-free profits from excessive or

duplicative insurance claims and the proceeds of crime are always taxable.

Specific policy wording usually clarifies where different companies insure the same risk.

Most insurers insist - on both application and claim forms – that they are advised of

137 Self-assessment?

138 It provisional and a work in progress

139 The Gourley principle

140 as payments from a personal insurance policy for sickness or disability benefits

141 but in the tax world there are always exceptions!

142 I.e. “own occupation” rather than any

Bates Number Bates No037 31 | Pa ge